How To List Dba On 1099

From there youll have the option to edit the information. Then select Vendors Center.

Microsoft Dynamics Gp Fall 2020 Add Dba Name Field On Vendor Maintenance Window For 1099 Vendors Microsoft Dynamics Gp Community

What Exactly Is Doing Business As.

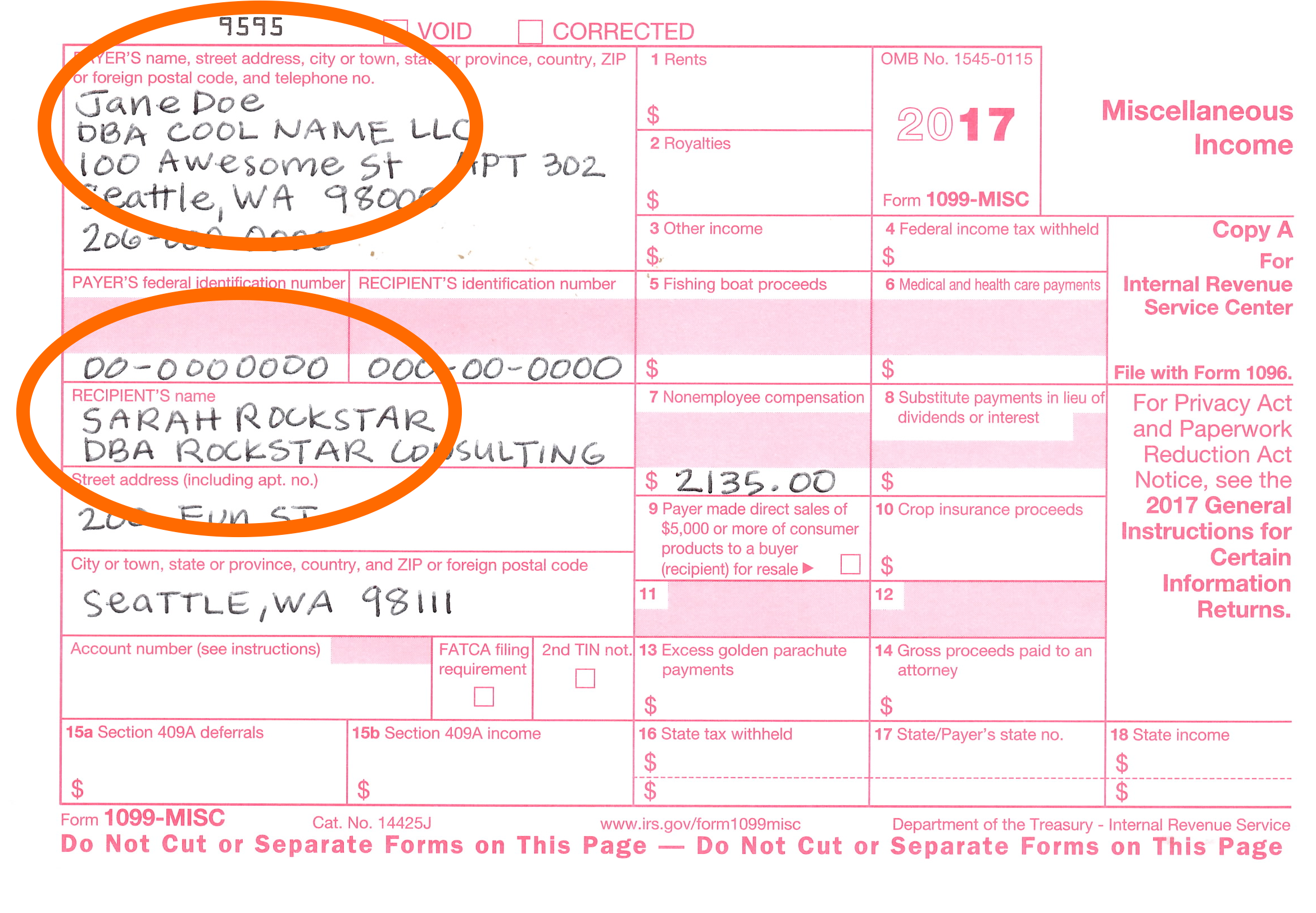

How to list dba on 1099. If we dont use the dba name which is the name they use on their invoices in the vendor name field we cant find the vendor but we need to have the tax return business name in the vendor name field when we report the 1099. Personal versus Business Expenses. The sole proprietors name goes on the first line the dba goes on the second line.

On the pop-up window click the Get Started button. Determine 1099 reportablity Let W9manager tell you if vendor payments have to be reported on a 1099-MISCNEC form. Your facts are unclear - did you obtain a separate EIN for your sole proprietorship.

On 1099s I give to contractors do I put my name or the DBA. Including 1099 Income on Your Tax Return. We are finding more and more businesses that have a different business name that they use on their tax return from the name they are doing business as.

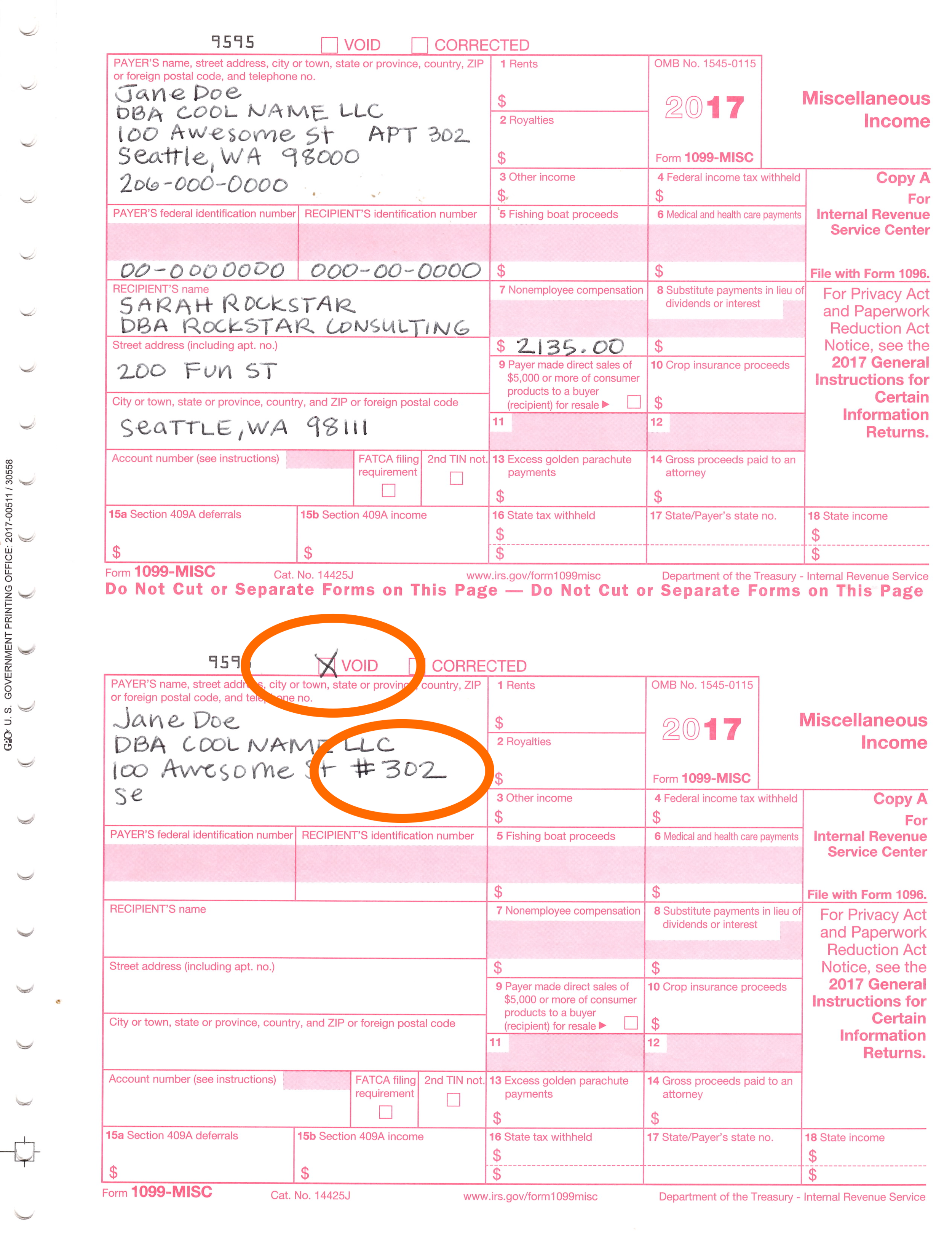

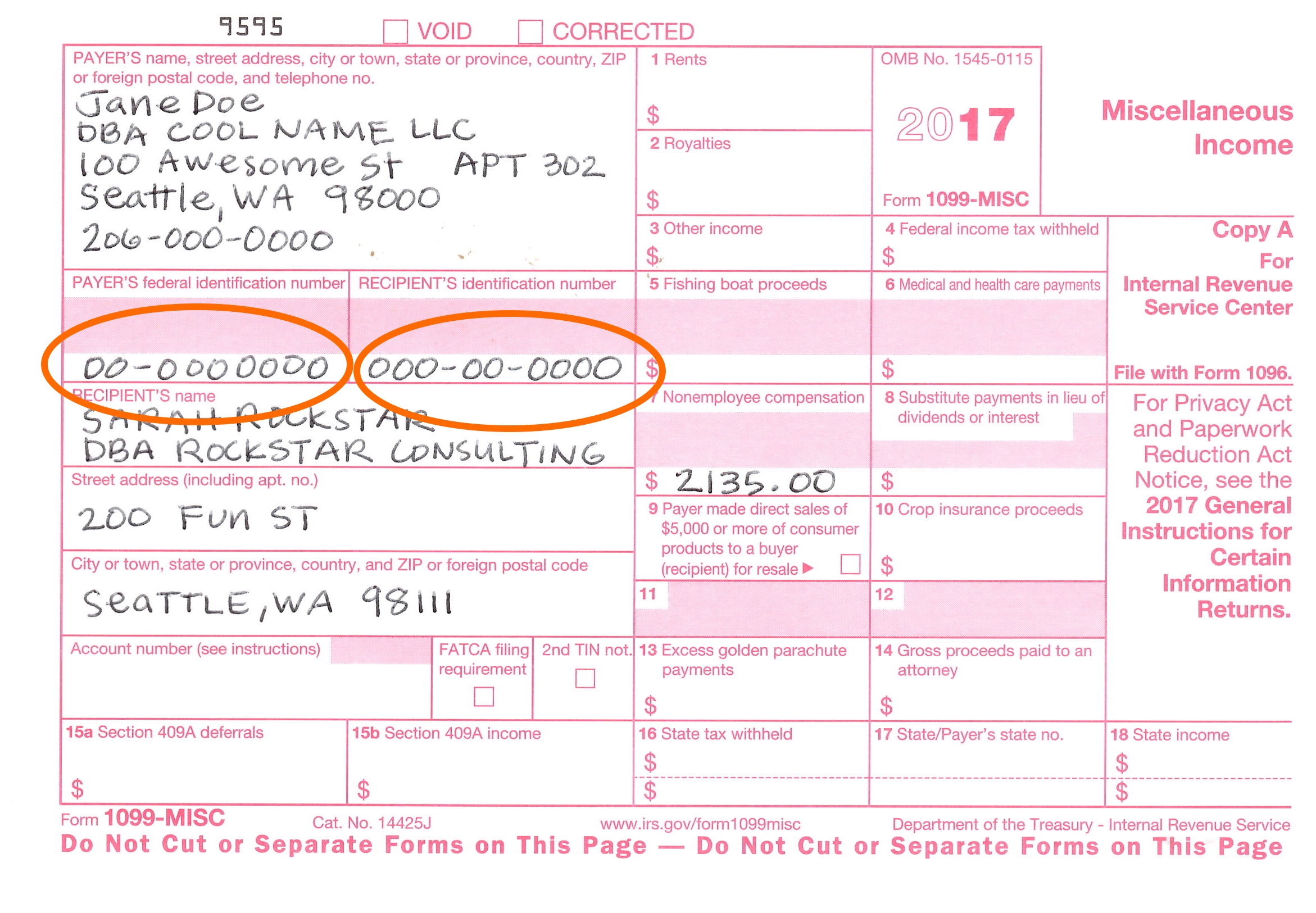

See the example below. Click the Vendors menu. Confirm the entries then finalize the form by either printing or e-filing it.

If Mikes Widgets LLC uses the tradename Awesome Widgets then the contract would identify the business as Mikes Widgets LLC an Arizona limited liability company dba Awesome Widgets. He stupidly thinks if you have some sort of official name. If we used their EIN number then their dba name would be listed first and then their individual name listed next.

Refer to chapters 7 and 8 of Publication 535 Business Expenses. File 1099s with the IRS Easily export your reportable vendors directly to our partner Tax2efile. Generally you cannot deduct personal living or family expenses.

In the US a DBA lets the public know who the real owner of a business is. Plans start at only 69year. Add a field in vendor masterfile for business name as shown on tax return for 1099 reporting.

Of all deductions available to contractors mileage and car expenses can provide one of the most sizable write offs. There is no option to put one on one line and the other on the next. The DBA is also called a fictitious business name or assumed business nameIt got its origins as a form of consumer protection so dishonest business owners couldnt try to avoid legal trouble by operating under a different name.

Review the payments on the next page. I looked up online and it says to put the dba under the persons name but there is not a spot that I see to do this on the Turbo Tax Online form. However if you have an expense for something that is used partly for business and partly for personal purposes divide the total cost between the.

Verify their information and other details then proceed with Continue. I am using the Online TurboTax Quick Employer Forms. You can elect to deduct or amortize certain business start-up costs.

I am trying to give a 1099 to my contractors and not sure if to put the DBA or my name. If you are a corporation he doesnt have to issue a 1099 at all. The example above will appear on 1099s as.

Enter the name recognized by your company the DBA Doing Business As name in the Name field. Map the accounts for the 1099. Choose your 1099 vendors then click Continue.

How you report 1099-MISC income on your income tax return depends on the type of business you own. If we used their EIN number then their dba name would be listed first and then their individual name listed next. A 1099 is prepared and filed with the IRS by the payor not the recipient of payments.

Insert doing business as or the acronym dba after the companys legal name followed by the dba. Enter the legal name of the entity as listed on the W-9 form in the DBA 1099 field. Choose 1099 Wizard.

If so the sole proprietorship would be the recipientIf not the income will be reported to. Choose vendor and click it to open the Vendors profile page. Select the Vendors tab.

I thought if we used their Social Security number on Form 1099-MISC then their first name should be listed on line 1 of the name section. Currently the regulations governing 1099 issuances are set to expand on January 1 2012. This is true whether the EIN or SSN is used.

Top Ten 1099 Tax Deductions 1 Car expenses and mileage. DOE created the Desk Guide to the Davis-Bacon Act to assist contractors and subcontractors performing construction work covered by the Davis-Bacon Act DBA as well as grantees subgrantees and federal personnel with understandable explanations of DBA requirements to assist all of these entities with DBA compliance issues. I am trying to input information into a 1099MISC for a person who uses a dba.

Hit the Address Info section. Whether you chose to have a DBA doing business as or not has not bearing on anything to the IRS. If you are a sole propietor sincle member LLC or individual he has to issue the 1099 in your name not a dba name anyway.

Youre allowed to write off any driving while working driving between gigs going to meet clients or driving out of town for business. If you are a sole proprietor or single-member LLC owner you report 1099 income on Schedule CProfit or Loss From BusinessWhen you complete Schedule C you report all business income and expenses.

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

1099 Forms Seattle Business Apothecary Resource Center For Self Employed Women

1099 Forms Seattle Business Apothecary Resource Center For Self Employed Women

Fast Answers About 1099 Forms For Independent Workers 1099 Tax Form Fillable Forms Irs Forms

Fast Answers About 1099 Forms For Independent Workers 1099 Tax Form Fillable Forms Irs Forms

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Solved 1099 Misc Adding 2nd Line For Recipient S Dba

Common 1099 Processing Questions

Common 1099 Processing Questions

1099 Forms Seattle Business Apothecary Resource Center For Self Employed Women

1099 Forms Seattle Business Apothecary Resource Center For Self Employed Women

Form 1099 Misc Vs Form 1099 Nec How Are They Different

Form 1099 Misc Vs Form 1099 Nec How Are They Different

Action Required For Tax Form 1099 Filers Blog For Accounting Quickbooks Tips Peak Advisers Denver

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Microsoft Dynamics Gp Fall 2020 Add Dba Name Field On Vendor Maintenance Window For 1099 Vendors Microsoft Dynamics Gp Community

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

1099 Forms Seattle Business Apothecary Resource Center For Self Employed Women

1099 Forms Seattle Business Apothecary Resource Center For Self Employed Women