How Long To Get Bounce Back Loan Hsbc

Some HSBC customers say the banks. Small businesses can receive up to 50000 through the scheme with more than one million firms accessing the funds.

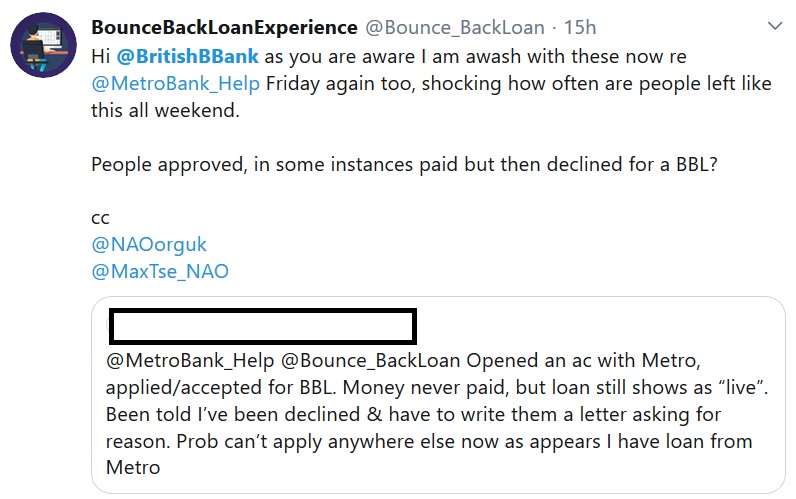

Metro Bank Declining Bounce Back Loans Initially Approved Mr Bounce Back Bounce Back Loan Complaints

Metro Bank Declining Bounce Back Loans Initially Approved Mr Bounce Back Bounce Back Loan Complaints

Call 2 one month later said funds should have been received 24 hours after returning loan.

How long to get bounce back loan hsbc. No repayments will be due during the first 12 months. Bounce back loans are part of a package of measures to help struggling companies cope with the impact of the coronavirus. Call your Relationship Manager or.

HSBC has kept more than a third 42 per cent of applicants for bounce back loans waiting more than a month before turning them down But almost one in. Call 1 advised funds would be expedited but couldnt say when payment might be made. I have now spent most of the day on the phone trying to sort this.

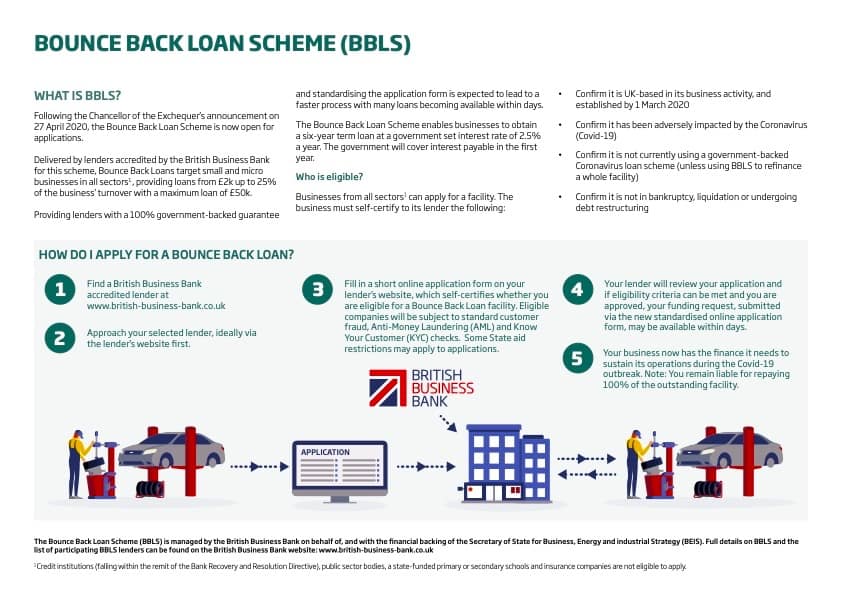

Borrowers will be be able to repay Bounce Back Loans over a long period of up to 10 years rather than six. You can apply for a Bounce Back Loan if you successfully opened a new Business Current Account HSBC Kinetic Current Account or Feeder Account and your application for the account was made before 9am on the 30 September 2020. No repayments required for the first 12 months.

The UKs biggest banks have been inundated with requests from small businesses for new coronavirus bounce-back loans with HSBC receiving 12800. HSBCs own bounce-back loan guidelines say it aims to respond to applications within a couple of days. On the first day 130000 businesses applied 34000 were applications to HSBC.

You can borrow between 2000 and 50000 with the cash arriving within days. If you opened an RBS Bank Business bank account after this date you will not be able to apply for a Bounce Back Loan with them. 11 May 2020 at 533PM.

The loan is 100 per cent government-backed for lenders allowing for low interest rates. Hi All applied for a Bounce Back loan at 930 Monday and have so far heard nothing from HSBC. Before your first repayment is due your lender will contact.

In a blow to the Treasury HSBC cannot process Bounce Back loans quickly enough to get money to businesses before the V-E Bank Holiday weekend it was revealed this morning. If you dont have a Relationship Manager call the Coronavirus Customer Support Line as soon as possible on 08000 121 614 from 0800 1800 Monday to Friday. The Bounce Back Loan Scheme has now closed For applications that were submitted before 1159pm on 31st March 2021 your application will continue to be processed.

Yesterday Sunak appeared to respond to that criticism by committing to underwrite 100 per cent of so-called bounce back loans worth up to 50000. On Monday at nine AM on the button the British Banking system fired the gun on the UK Governments Bounce Back Loan scheme BBILSs. Key points of the BBL scheme.

No repayment of capital required during the period of 12 months. HSBC in disarray on Bounce Back Loans. Rishi Sunak was keen to move on from the troubled Covid Business Interruption Loans initiative where just 50 of applicants received approval in the first five weeks of its operation with 80 having to wait at least three weeks.

Currently this is set to a flat rate of 25 per cent interest. Government covers first 12 months of interest and fees. The length of the loan is 6 years but you can repay early without paying a fee.

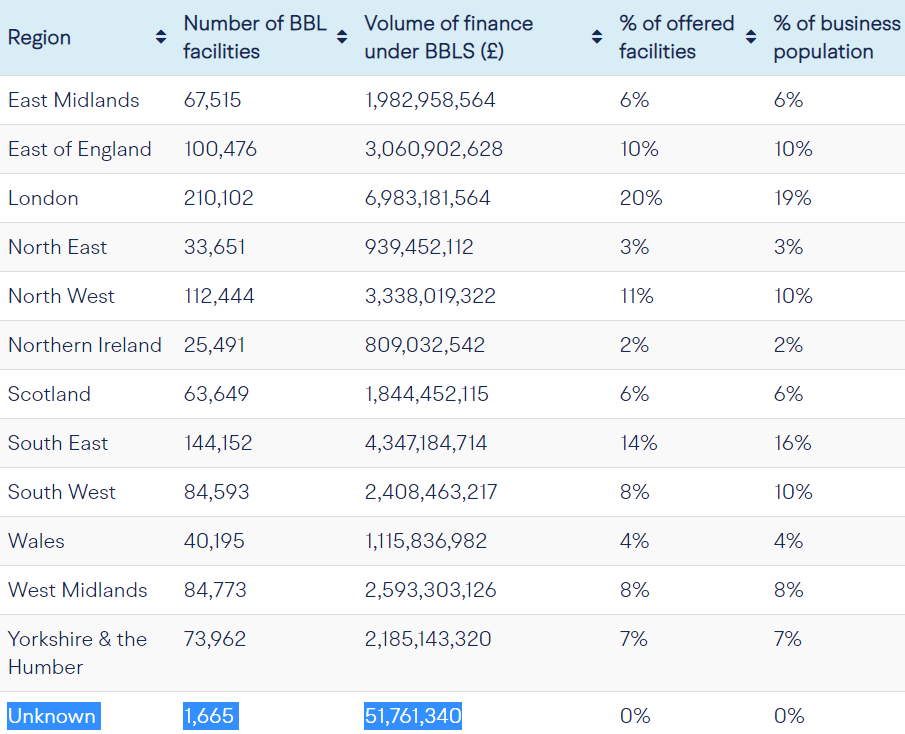

TSB Bank Bounce Back Loan Website. Bounce back loans are 100 state-backed worth up to 50000 and with no interest charged or repayments needed in the first 12 months. More than 15 million businesses struggling due to coronavirus took out a bounce back loan before the scheme closed to applications on 31 March 2021.

The political message to small business owners was clear bounce back money in your bank in 24 hours. Applicants will be updated via email. Rishi Sunak announced changes to make Bounce Back Loans repayments more affordable in his Winter Economy Plan on 24 September.

March 30 2021 Less Than 48 Hours Left to Apply for a Bounce Back Loan or a BBL Top Up Bounce Back Loan News Archive March 30 2021 NatWest Playing Dumb with BBL PAYG Options for Customers They Closed the Accounts Of Premium Content. Half of small businesses will never repay Bounce Back Loans warn banks. RBS Bank Bounce Back Loans are available to existing RBS Bank customers on or before the 4 th of May 2020.

Backed by an 100 Government guarantee HSBC UK will provide lending of between 2000 and 50000 up to a maximum of 25 annual turnover and any business can apply online at wwwcbilbusinesshsbccoukbbls. If you are concerned that you cannot meet the repayments on your loan after 12 months then either. TSB Bank You can only apply for a Bounce Back Loan with TSB if your account was open before the 11 th of May 2020.

Company B applied for bounce back loan 2 days later also from HSBC loan agreed but loan agrement still not received. Yet HSBC business customers say they have been left hanging for weeks for approved applications to be processed and money to appear in their accounts. Today I have spoken to the BBlS Dept and they said I need to wait for an email but have given no idea on time frame.

Company A has made 2 calls to HSBC holding for over 30 minutes each time before answered.

Bounce Back Loan Scheme Bbls Credit Passport

Bounce Back Loan Scheme Bbls Credit Passport

Apply For A Business Bounce Back Loan Bbbl Makesworth Accountants

Apply For A Business Bounce Back Loan Bbbl Makesworth Accountants

Problems With The Shared Industry Database Mr Bounce Back Bounce Back Loan Complaints

Problems With The Shared Industry Database Mr Bounce Back Bounce Back Loan Complaints

Bounce Back Loan Fraud The Elephant In The Room Mr Bounce Back Bounce Back Loan Complaints

Bounce Back Loan Fraud The Elephant In The Room Mr Bounce Back Bounce Back Loan Complaints

69 000 Bounce Back Loans Worth Over 2 Billion Approved In 24 Hours

69 000 Bounce Back Loans Worth Over 2 Billion Approved In 24 Hours

Bounce Back Loan Lenders Only Traditional Banks So Far

Bounce Back Loan Lenders Only Traditional Banks So Far

August 15th Bounce Back Loans Update Mr Bounce Back Bounce Back Loan Complaints

August 15th Bounce Back Loans Update Mr Bounce Back Bounce Back Loan Complaints

Bounce Back Loan Support Bouncebackloan Twitter

Bounce Back Loan Support Bouncebackloan Twitter

Bounce Back Loan Uber Drivers Forum

Santander Uk Help On Twitter Hi There You Can Apply For A Bounce Back Loan We Would Just Ask That You Have A Santander Current Account Be A Uk Based Business Impacted

Santander Uk Help On Twitter Hi There You Can Apply For A Bounce Back Loan We Would Just Ask That You Have A Santander Current Account Be A Uk Based Business Impacted

What Happens If I Default On My Bounce Back Loan

What Happens If I Default On My Bounce Back Loan

Hsbc Uk Business On Twitter Bounce Back Loan Update As At 18 May We Have Approved Over 80 000 Bb Loans Worth Over 2 7bn We Are Working Hard To Process Bbl Applications As

Hsbc Uk Business On Twitter Bounce Back Loan Update As At 18 May We Have Approved Over 80 000 Bb Loans Worth Over 2 7bn We Are Working Hard To Process Bbl Applications As

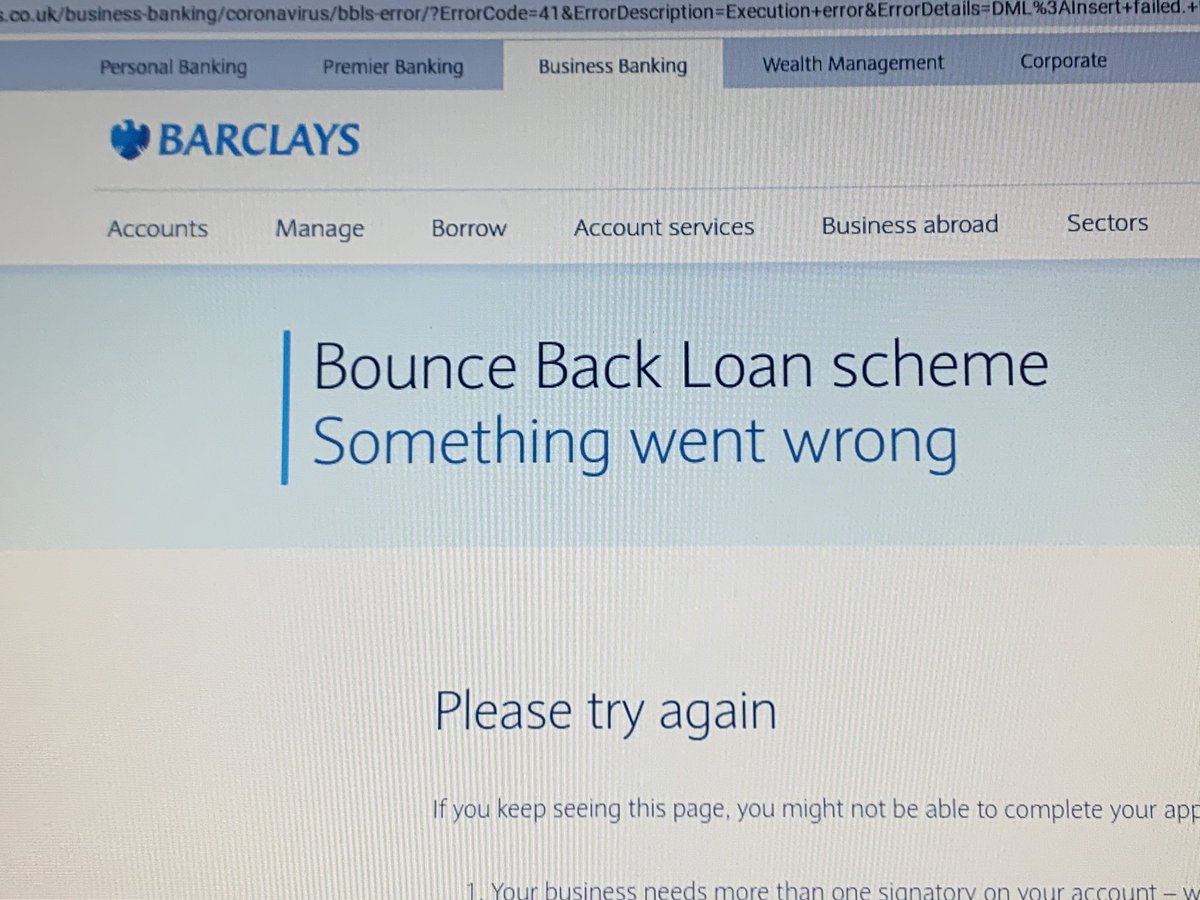

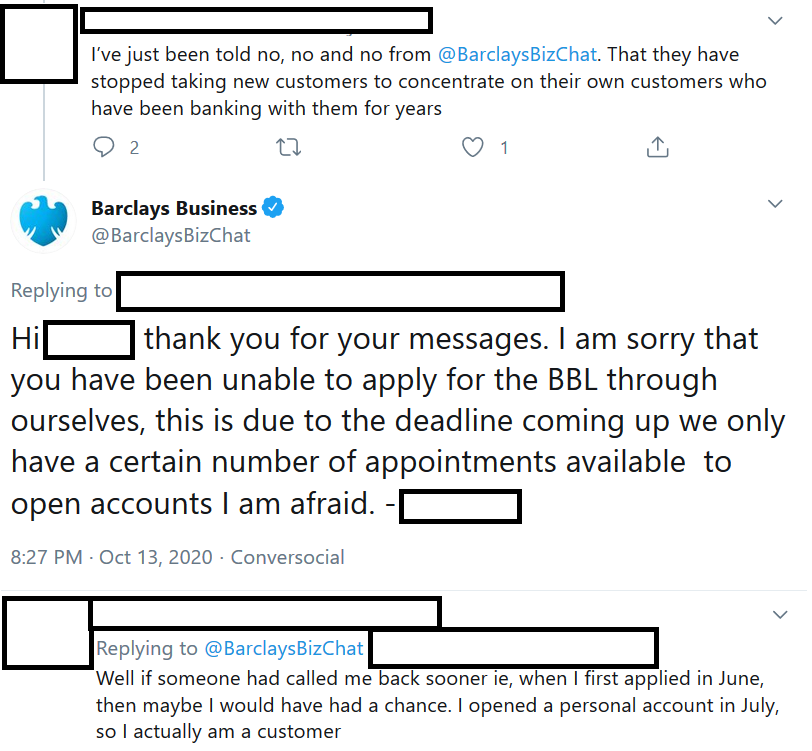

Barclays Slam The Door On New Customers Seeking A Bounce Back Loan Mr Bounce Back Bounce Back Loan Complaints

Barclays Slam The Door On New Customers Seeking A Bounce Back Loan Mr Bounce Back Bounce Back Loan Complaints

Bounce Back Loan All You Need To Know Abundance Aware

Bounce Back Loan All You Need To Know Abundance Aware

Coronavirus Bounce Back Loan Scheme For Uk Small Businesses

Coronavirus Bounce Back Loan Scheme For Uk Small Businesses

Coronavirus Barclays Customers Struggle To Get Vital Loans Bbc News

Coronavirus Barclays Customers Struggle To Get Vital Loans Bbc News

Bounce Back Loan Scheme Ni Hardship Fund Malone Accountingmalone Accounting

Bounce Back Loan Scheme Ni Hardship Fund Malone Accountingmalone Accounting

Bounce Back Loans Helped Companies Not Just Survive But Expand

Bounce Back Loan All You Need To Know Abundance Aware

Bounce Back Loan All You Need To Know Abundance Aware