Will Robinhood Send Me A 1099

Robinhood sent me a consolidated 1099 which contains information about the 1099-DIV 1099-MISC and 1099-B. Similar to other types of tax documents received at year end W2 etc you can import this 1099-B that you receive from Robinhood into tax.

Deciphering Form 1099 B Novel Investor

Deciphering Form 1099 B Novel Investor

Robinhood will send you a tax form to show all the.

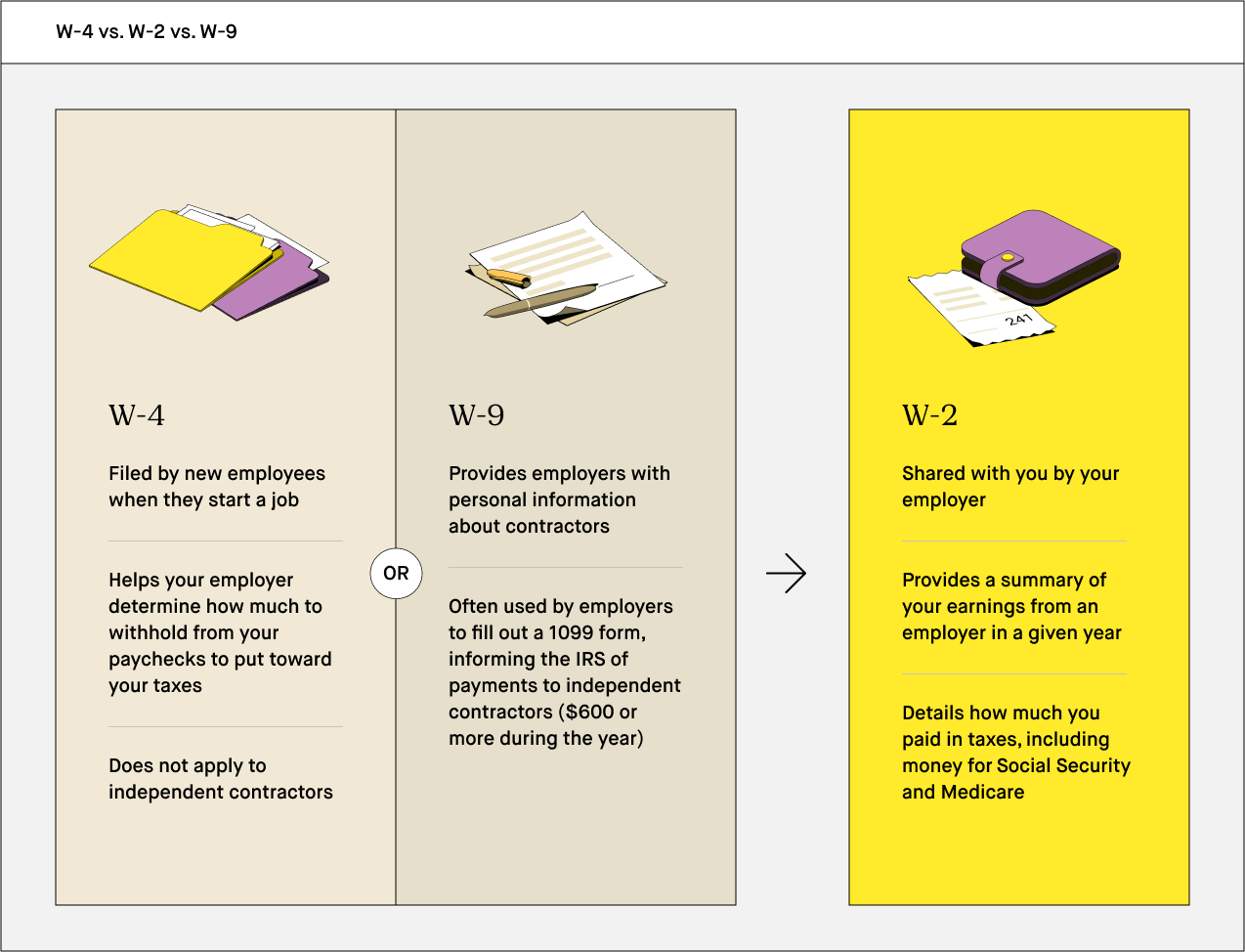

Will robinhood send me a 1099. You wont need any 1099 forms from Robinhood this year so you dont need to wait on us to start filing your taxes. You are a Coinbase customer AND You are a US person for tax purposes AND You have earned 600 or more in rewards or fees from Coinbase Earn USDC Rewards andor Staking in 2020. Theres the 1099-B form from brokers the 1099-INT reporting interest income and the 1099-DIV for dividends.

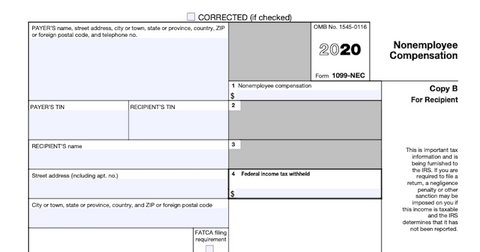

The 1099-NEC form is replacing the Form 1099-MISC for miscellaneous income from previous tax years. Securities trading is offered to self-directed customers by Robinhood Financial. My tax program not Turbotax asks me to fill out things like nonemployee compensation on the 1099-MISC and some other things on the 1099-B which are not reported on Robinhoods consolidated 1099.

Your consolidated 1099 form will come up in the mail from Robinhood Securities Robinhood Crypto or Apex Clearing. A few companies like Microsoft and apple paid some dividends quarterly throughout 2018. So basically dont rush to file your taxes.

I know I still have to report it but I dont know how. My friends have all gotten theres over a month ago with other brokerages. Compounding the discontent was the fact that as observed by Twitter users wording on the Robinhood website appeared to change from promising the forms by February 16th to starting February.

This Form is known as 1099-B. Everything is zero on the 1099-MISC and 1099-B forms. You can download your 1099-B right from your Robinhood account.

People who have sold stocks options or cryptocurrencies in 2020 must file a 1099 an IRS form that banks and brokerages send to customers documenting their earnings losses and tax. There are many varieties including 1099-INT for interest 1099-DIV for dividends 1099-G for tax refunds 1099-R for pensions and 1099-MISC for. If you completed taxable transactions on your Robinhood stocks account then the company will send you the 1099 tax document.

All investments involve risk and loss of capital. You will not receive a 1099 for your dividend income if your proceeds are less than 10. Consider this a heads up that your Robinhood 1099 form may be corrected as well.

Depending on when and what trades you made your form can show up from slightly different companies. I tried to make a post regarding this on rRobinhood but was quickly shot down. I received a total of 16 in dividend from these companies but Robinhood told me that I will not receive a 1099div from them because they had a split between Apex and Rhs last year and my dividends were less than 10 from each.

You can access the tax form under Tax Documents in. No one has gotten their 2020 Robinhood 1099 yet. Because Robinhood is not a native cryptocurrency company it is indeed able to give a complete gains and losses report to its users.

If Robinhood manages to send it right the first time instead of correcting it like last year that would be cool. Compounding the discontent was the fact that as observed by Twitter users wording on the Robinhood website appeared to change from promising the forms by February 16th to. You may receive a 1099-MISC if.

Automod removed my post and the mods mocked me and refused to fix it - claiming that everyone there is 18 and can figure it out themselves. Some firms consolidate all activity on one form. Robinhood means Robinhood Markets and its in-application and web experiences with its family of wholly owned subsidiaries which includes Robinhood Financial Robinhood Securities and Robinhood Crypto.

I sold stock through Robinhood in 2020 but because I didnt meet a certain limit they didnt send me a 1099b. Proceeds from Broker and Barter Exchange is a federal tax form used by brokerages and barter exchanges to record customers gains and losses during a tax year.

How To File Robinhood 1099 Taxes

How To File Robinhood 1099 Taxes

1099 Misc Forms The What When How Buildium Irs Forms 1099 Tax Form Fillable Forms

1099 Misc Forms The What When How Buildium Irs Forms 1099 Tax Form Fillable Forms

Robinhood Traders Demand Missing 1099 Tax Forms

Robinhood Traders Demand Missing 1099 Tax Forms

/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png) Form 1099 Oid Original Issue Discount Definition

Form 1099 Oid Original Issue Discount Definition

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

How To Read Your 1099 Robinhood

How To Read Your 1099 Robinhood

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

How To Read Your Brokerage 1099 Tax Form Youtube

How To Read Your Brokerage 1099 Tax Form Youtube

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Robinhood Taxes Explained How To File Robinhood Taxes On Turbotax Youtube

Robinhood Taxes Explained How To File Robinhood Taxes On Turbotax Youtube

What Is A W 9 Form 2020 Robinhood

What Is A W 9 Form 2020 Robinhood

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker Barter Exchange Transactions

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker Barter Exchange Transactions

/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg) Form 1099 B Proceeds From Broker And Barter Exchange Definition

Form 1099 B Proceeds From Broker And Barter Exchange Definition

How Do You Pay Taxes On Robinhood Stocks

How Do You Pay Taxes On Robinhood Stocks

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

How To Prepare And File A 1099 For Contract And Freelance Workers

How To Prepare And File A 1099 For Contract And Freelance Workers

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

:max_bytes(150000):strip_icc()/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg) Form 1099 B Proceeds From Broker And Barter Exchange Definition

Form 1099 B Proceeds From Broker And Barter Exchange Definition