Taken Collectively This Form Of Business Organization Generates The Highest Level Of Income

The business first records its total sales and then subtracts all expenses taxes and depreciation. Are included on your personal income tax return.

Federal Register Labor Organization Annual Financial Reports For Trusts In Which A Labor Organization Is Interested Form T 1

Federal Register Labor Organization Annual Financial Reports For Trusts In Which A Labor Organization Is Interested Form T 1

Qualified Business Income Deduction.

Taken collectively this form of business organization generates the highest level of income. The well-being gained through commodities stems from the price-quality relations of the commodities. A sole proprietorship is the most common form of business organization. What form your business adopts will affect a multitude of factors many of which will decide your companys future.

Becoming an owner in part or in full of a business such as an MLP or LP is not considered within the exempt purpose of the IRA. Business revenue can be used to invest in factories machinery or new technologies. Answer to Taken collectively this form of business organization generates the highest level of income.

Before reinvesting a business must estimate its cash flow. They can allocate income or loss to specific partners to generate a valuable tax deferral for that member. But the business owner is also personally liable for all financial obligations and debts of the business.

Aligning your goals to your business organization type is an important step so understanding the pros and cons of each type is crucial. The new tax rate effective 100220 is 18. --Easiest and least costly form of business organization to set up--Pay only one level of income taxes--Proprietor receives all profits generated by the business.

As a sole proprietor you can operate any kind of business. The producer community generates income from developing and growing production. A sole proprietorship is the most common form of business organization.

A is entitled to a deduction of 40000 200000 20. Sole proprietorship b. It is important that the business owner seriously considers the different forms of business organizationtypes such as sole proprietorship partnership and corporationWhich organizational form is most appropriate can be influenced by tax issues legal.

Its easy to form and offers complete control to the owner. A partnership is a straightforward business organization type to create. Its easy to form and offers complete managerial control to the owner.

This is an ownership interest in the partnership. Those participating in production ie the labour force society and owners are collectively referred to as the producer community or producers. An exempt organization that has 1000 or more of gross income from an unrelated business must file Form 990-T PDF.

All Cincinnati residents who receive taxable compensation are required to pay the City of Cincinnati income tax at the rate of 21 thru 100120 and 18 effective 100220. The NCAA brings in 1 billon a year in revenue most of which is generated by March Madness but doesnt allow its college athletes to be paid. An organization must pay estimated tax if it expects its tax for the year to be 500 or more.

Many owners of sole proprietorships partnerships S corporations and some trusts and estates may be eligible for a qualified business income QBI deduction also called Section 199A for tax years beginning after December 31 2017. Your companys form will affect. The obligation to file Form 990-T is in addition to the obligation to file the annual information return Form 990 990-EZ or 990-PF.

During 2018 the business generates 200000 of income to A and As total taxable income after deductions is 215000. How you are taxed. The deduction allows eligible taxpayers to deduct up to 20 percent of their qualified business income QBI plus 20.

What type of business organization generates the most total sales 1 General Partnership 2 Corporation 3 Sole proprietorship 4 Cooperative 5 Partnership. From a taxation perspective the form of business organization with the highest business level taxes is the _____. The result is the businesss net income.

This tax must be paid to the City of Cincinnati regardless of your age or level of income. The most common forms of business enterprises in use in the United States are the sole proprietorship general partnership limited liability company LLC and corporation. It requires an agreement that may be verbal or written.

MLPs and LPs may generate taxable income in a retirement account if the partnership borrows money also known as using leverage.

4 Types Of Entrepreneurship Tips For Women In Business

4 Types Of Entrepreneurship Tips For Women In Business

Federal Register Labor Organization Annual Financial Reports For Trusts In Which A Labor Organization Is Interested Form T 1

Federal Register Labor Organization Annual Financial Reports For Trusts In Which A Labor Organization Is Interested Form T 1

Corporations Financial Accounting

Corporations Financial Accounting

Cambridge International As A Level Business Course Book Sample By Cambridge University Press Education Issuu

Cambridge International As A Level Business Course Book Sample By Cambridge University Press Education Issuu

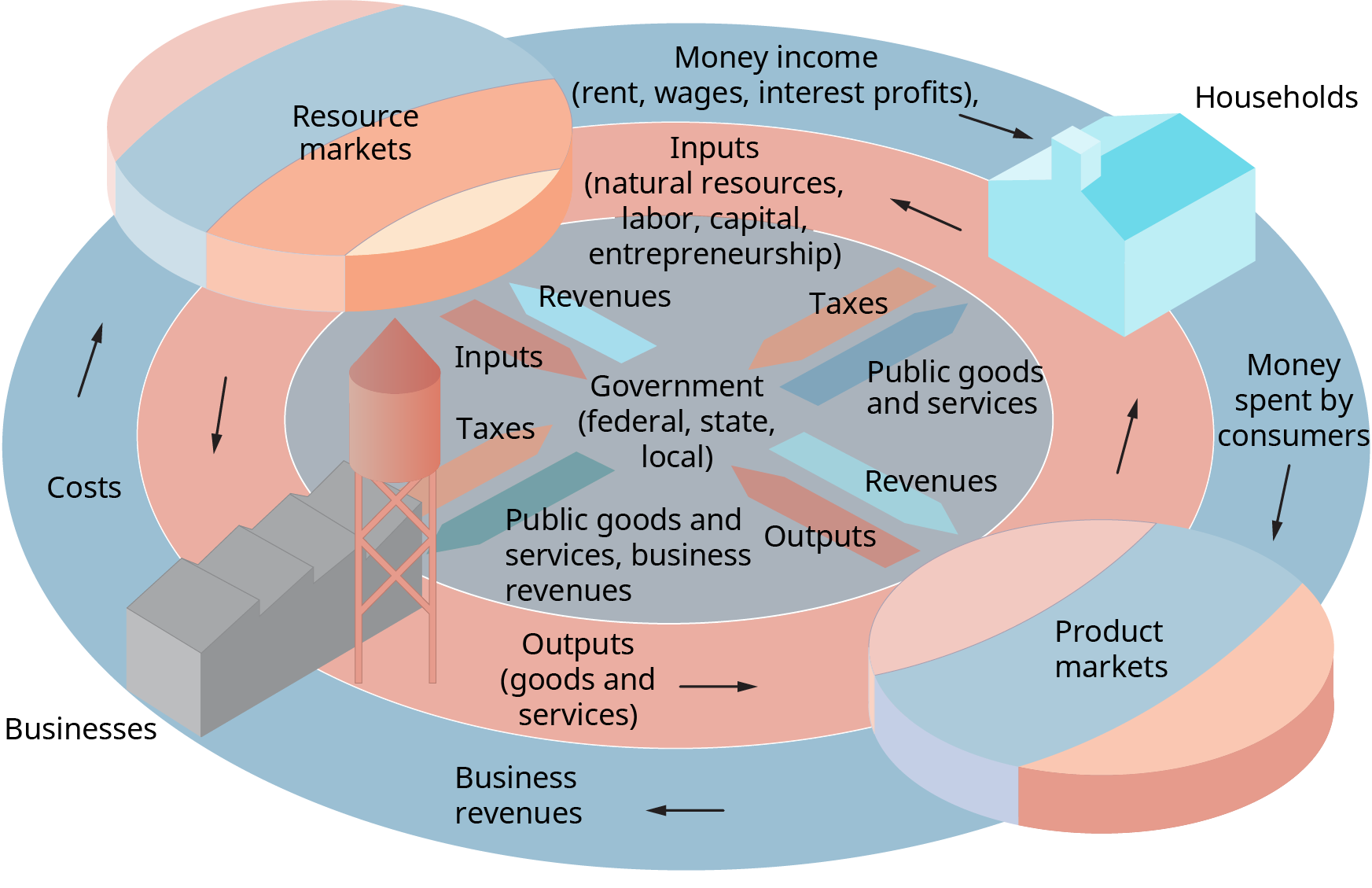

How Business And Economics Work Introduction To Business

How Business And Economics Work Introduction To Business

Https Www Jstor Org Stable 43932444

3 13 2 Bmf Account Numbers Internal Revenue Service

3 13 2 Bmf Account Numbers Internal Revenue Service

Https Www Cambridge Org Es Download File 968575 134388

Https Www Jstor Org Stable 40698409

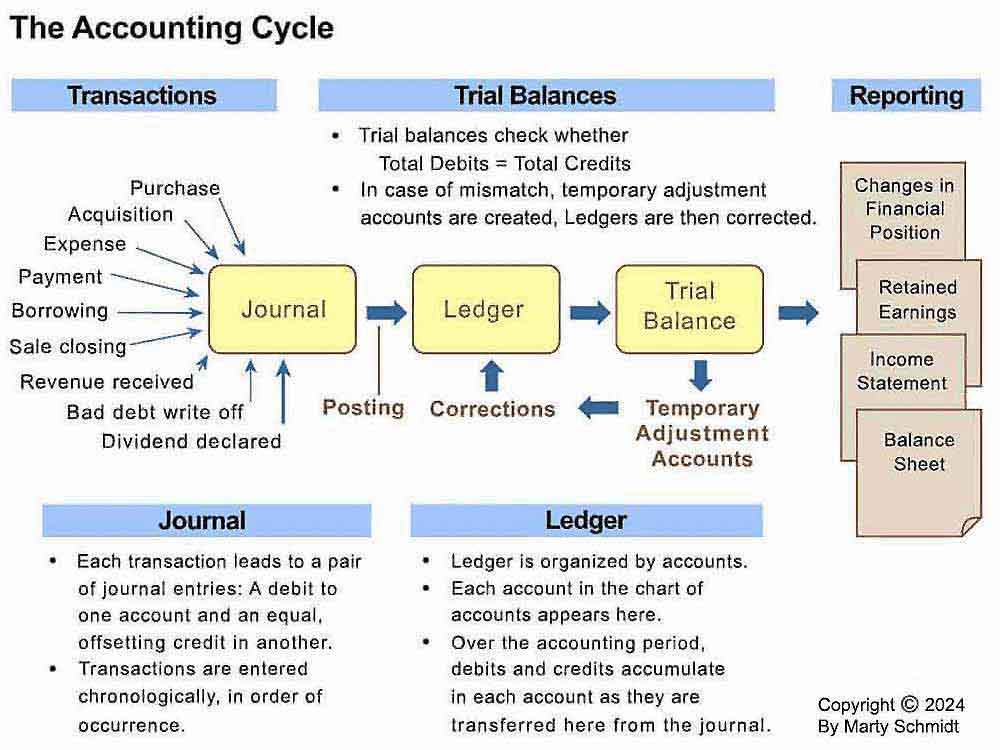

Ledger General Ledger Role In Accounting Defined And Explained

Ledger General Ledger Role In Accounting Defined And Explained

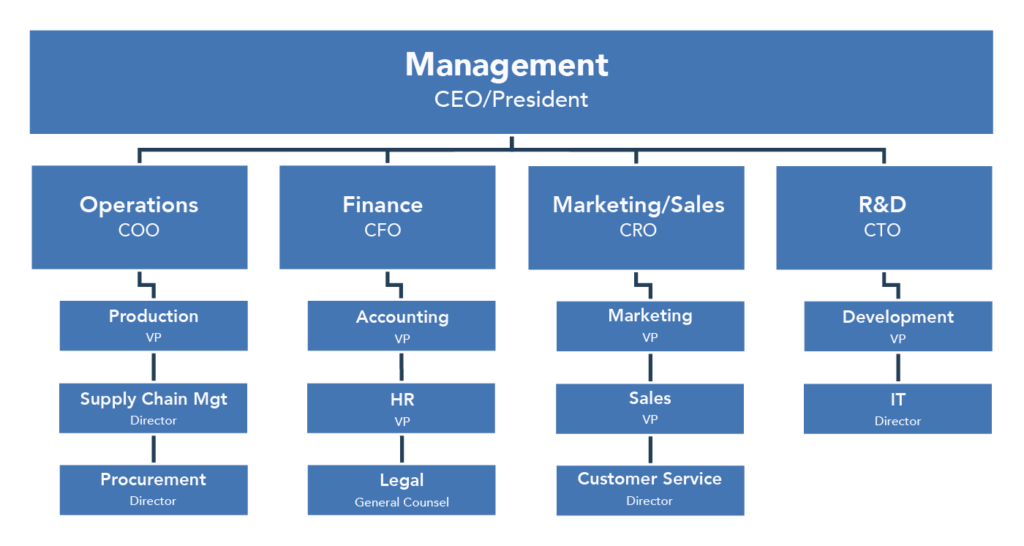

Functional Areas Of Business Introduction To Business

Functional Areas Of Business Introduction To Business

Https Www Jstor Org Stable 41789620

How To Choose The Perfect Name For Your Business The Collective Mill Business Names Event Planning Business Start Up Business

How To Choose The Perfect Name For Your Business The Collective Mill Business Names Event Planning Business Start Up Business

Isingiro Community Based Climate Change Adaptation In Banana Livestock System Climate Change Climates Ecosystems

Isingiro Community Based Climate Change Adaptation In Banana Livestock System Climate Change Climates Ecosystems

Ab Commercial Real Estate Income Fund Llc

Ab Commercial Real Estate Income Fund Llc

Https Www Jstor Org Stable 40295083

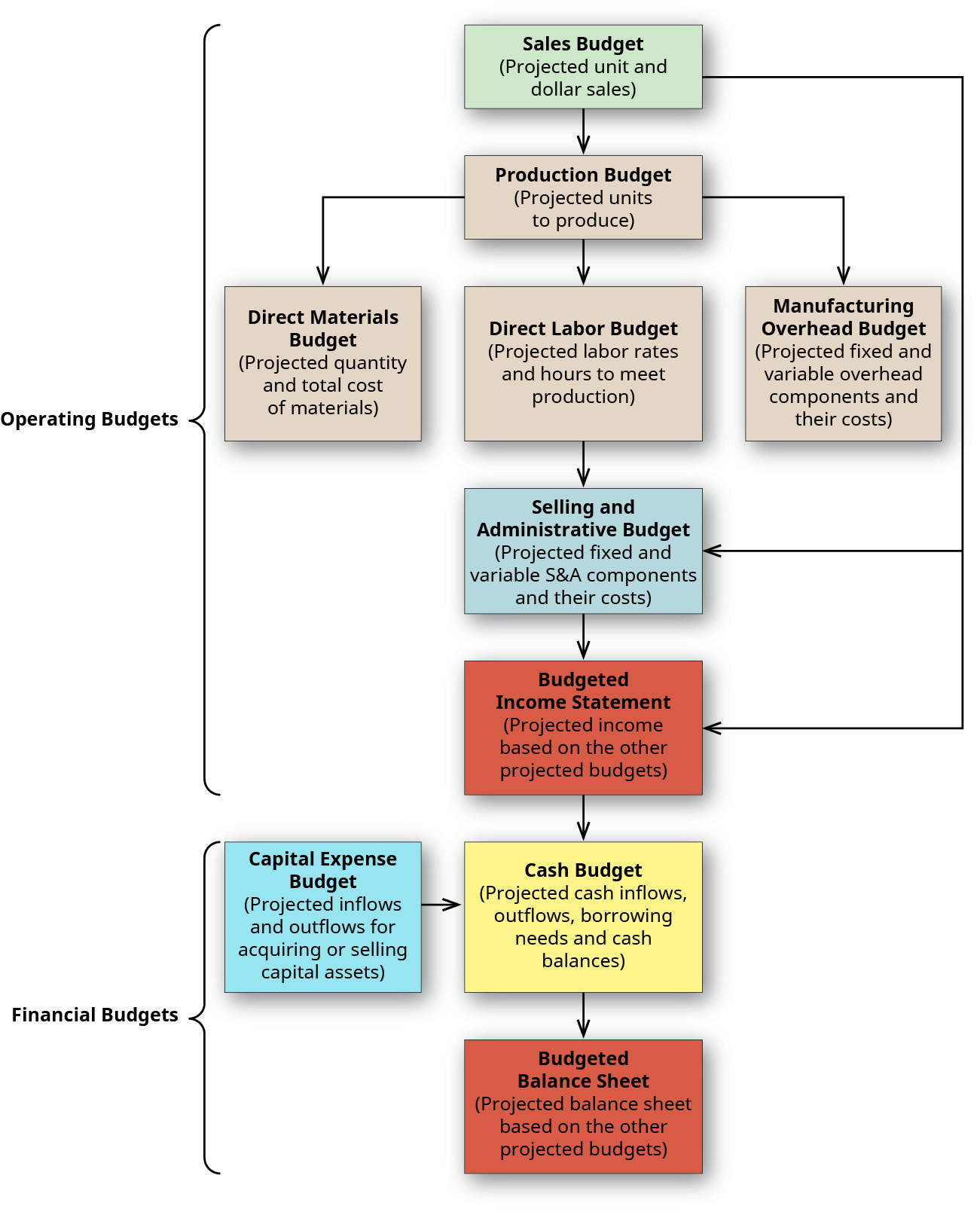

Describe How And Why Managers Use Budgets Principles Of Accounting Volume 2 Managerial Accounting

Describe How And Why Managers Use Budgets Principles Of Accounting Volume 2 Managerial Accounting

Functional Areas Of Business Introduction To Business

Functional Areas Of Business Introduction To Business

Business Entity Types A Simple Guide Bench Accounting

Business Entity Types A Simple Guide Bench Accounting