Do Law Firms Get A 1099-nec

Examples of this include freelance work or driving for DoorDash or Uber. Professional service fees to attorneys including law firms established as corporations accountants architects etc.

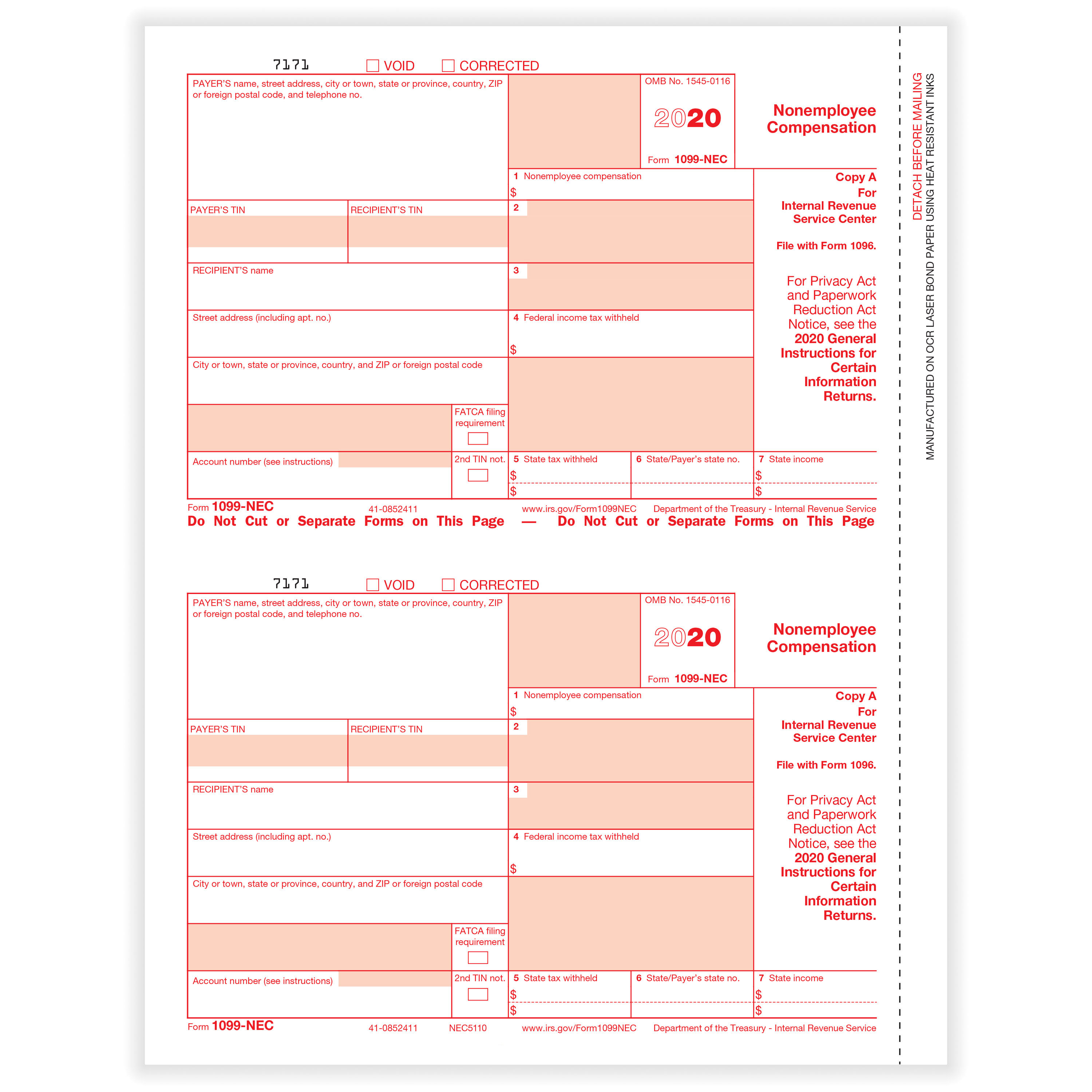

1099 Nec Recipient Copy B Cut Sheet Hrdirect

1099 Nec Recipient Copy B Cut Sheet Hrdirect

Other Items You May Find Useful.

Do law firms get a 1099-nec. However the IRS explained that some types of payments to attorneys or law firms are considered gross proceeds must still be reported on Form 1099-MISC if they total 600 or more. The 1099-NEC is the new form to report nonemployee compensationthat is pay from independent contractor jobs also sometimes referred to as self-employment income. Form 1099-NEC is only replacing the use of Form 1099-MISC for reporting independent contractor payments.

Use Form 1099-NEC to report nonemployee compensation. This is to get the correct Tax Payer Identification Number TIN like a Social Security. Plus any client paying a law firm more than 600 in a year as part of the clients business must issue a Form 1099.

Businesses will need to use this. Professional service fees to architects designers accountants software engineers attorneys and law firms Fees paid by one professional to another Commissions to non-employee salespeople that are subject to repayment but havent been repaid in the course of the year. 600 or more paid in the course of your trade or business You must also file Form 1099-NEC for each person you have withheld any federal income tax box 4 under the backup withholding rules regardless of the amount of the payment.

What is Form 1099-NEC. Payments to an attorney that are not for the attorneys services but are connected to legal services. It said that gross proceeds include the following.

Forms 1099 are generally issued in January of the year after payment. All Form 1099-NEC Revisions. Do use 1099-NEC to report attorney fees for services.

Fees paid by one professional to another fee-splitting for example. Payments to an attorney in box 1 Attorneys fees of. Instructions for Form 1099-MISC and Form 1099-NEC Print Version PDF Recent Developments.

Although the 1099-MISC is still in use contractor payments made in. Attorneys fees of 600 or more paid in the course of your trade or business are reportable in box 1 of Form 1099-NEC under section 6041A a 1. Previously companies reported this income information on Form 1099-MISC Box 7.

Its a common belief that businesses dont need to send out 1099-NEC forms to corporations. It was last used in 1982. The answer is no because the kitchen remodeling was for personal not business reasons.

When to send 1099-NEC to vendors contractors. The term attorney includes a law firm or other provider of legal services. Here are some examples of payments you need to report on the 1099-NEC.

Form 1099-NEC Nonemployee Compensation is a form that solely reports nonemployee compensation. Gross proceeds paid to attorneys. In general you dont have to issue 1099-NEC forms to C-Corporations and S-Corporations.

Settlement agreements or other legal payments that are not for the attorneys service use 1099-MISC instead. Besides the filing of the 1099-NEC form you will also need to have the payee fill out and sign a Form W-9. And this is true.

Form 1099-NEC is not a replacement for Form 1099-MISC. This also includes payments to a law firm or fish purchases. Some examples of payments you must report on Form 1099-NEC include.

But the 1099-MISC form is still around its just used to report miscellaneous income such as rent or payments to an attorney. According to the IRS organizations must file form 1099-NEC for each person who is not classified as an employee to whom they have paid at least 600 for services performed. A lawyer or law firm paying fees to co-counsel or a referral fee to a lawyer must issue a Form 1099 regardless of how the lawyer or law firm is organized.

And the 1099-NEC is actually not a new form. The 1099-NEC is now used to report independent contractor income. The payments made to the payee were at least 600 or more for the year.

Do you need to issue a 1099-NEC. None at this time. Do not use 1099-NEC to report gross proceeds to any attorney for example.

Unfortunately IRS Publication 1220 makes it clear that Form 1099-NEC will not be included in. Under the IRS combined FederalState filing program information reported to the IRS on several types of tax and payroll forms is automatically shared with state tax authorities. Beginning with the 2020 tax year the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099-NEC instead of on Form 1099-MISC.

1099 Misc And 1099 Nec Deadline Feb 1 2021 Tax Practice Advisor

1099 Misc And 1099 Nec Deadline Feb 1 2021 Tax Practice Advisor

1099 Nec Federal Copy A Cut Sheet Hrdirect

1099 Nec Federal Copy A Cut Sheet Hrdirect

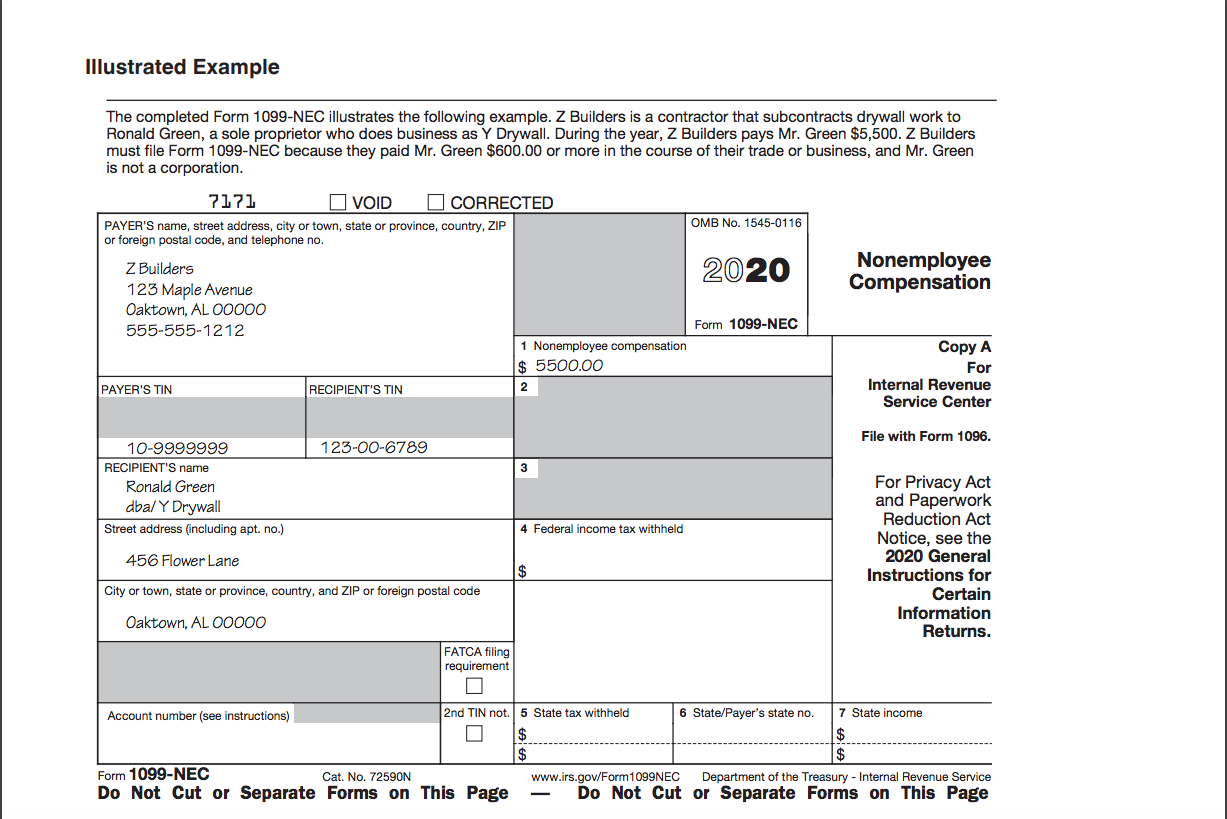

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Introducing The New 1099 Nec For Reporting Nonemployee Compensation Asap Accounting Payroll

Introducing The New 1099 Nec For Reporting Nonemployee Compensation Asap Accounting Payroll

1099 Nec The Dancing Accountant

1099 Nec The Dancing Accountant

Irs Form 1099 Misc Irs Form 1099 Nec Lancaster Cpa Firm

Irs Form 1099 Misc Irs Form 1099 Nec Lancaster Cpa Firm

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

How To Use The New 1099 Nec Form For 2020 Dynamic Tech Services

How To Use The New 1099 Nec Form For 2020 Dynamic Tech Services

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

What Is Form 1099 Nec Business Quick Magazine

What Is Form 1099 Nec Business Quick Magazine

Questions And Answers About Form 1099 Nec

Questions And Answers About Form 1099 Nec

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

Irs Adds Form 1099 Nec Non Employee Compensation To Year End Employer Report Forms Toyer Dietrich And Associates

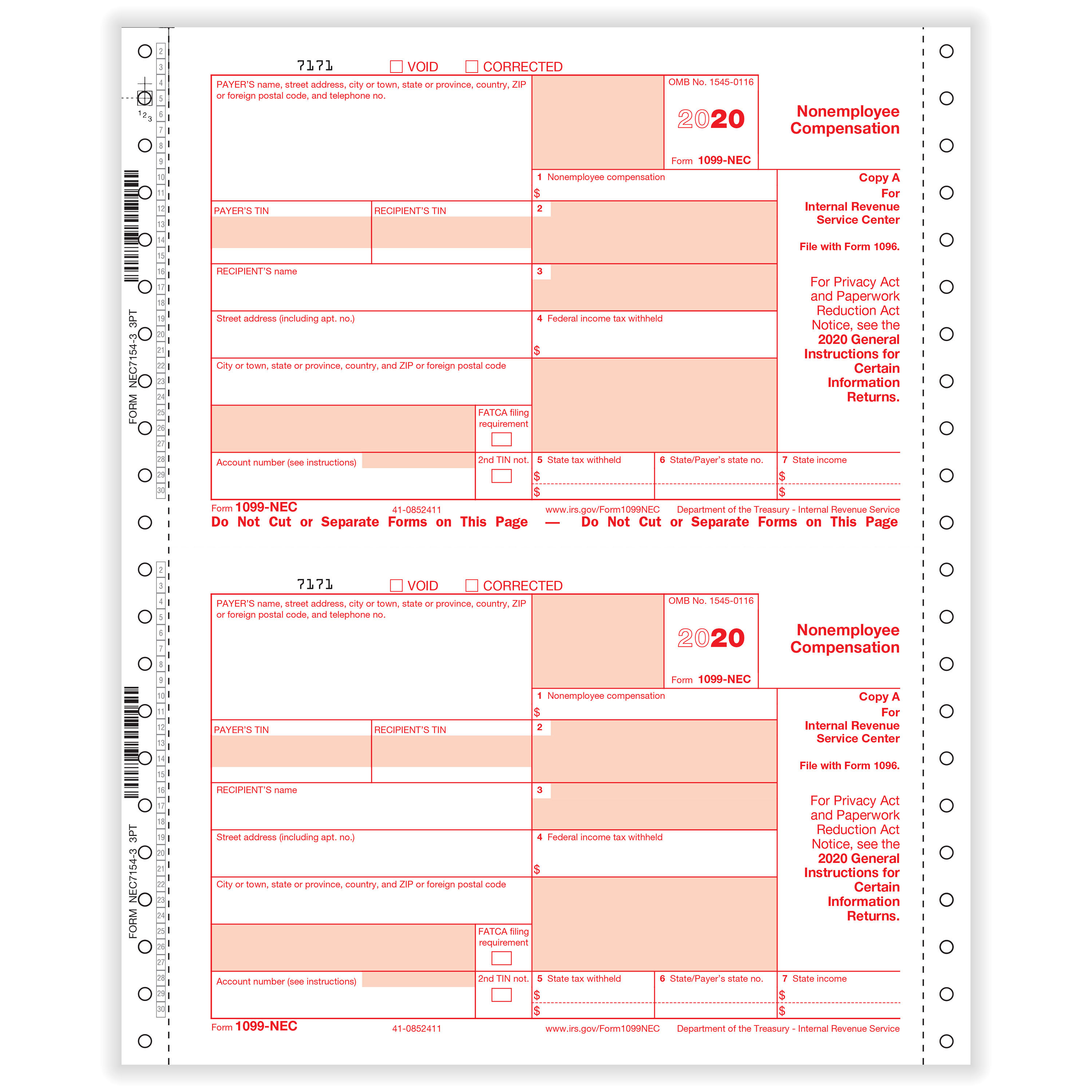

1099 Nec Continuous Forms Set Hrdirect

1099 Nec Continuous Forms Set Hrdirect