Does Paypal Issue 1099-nec

When does PayPal Send out 1099 and when can I start selling again. Only those customers that meet the 1099-K eligibility requirements will see the 1099-K available for download in their account.

Tax Statements You Need To File Your 2020 Return Don T Mess With Taxes

Electronic payments made to businesses using a credit card debit card or a payment processor like Paypal or Stripe are reported to the IRS separately using Form 1099 K.

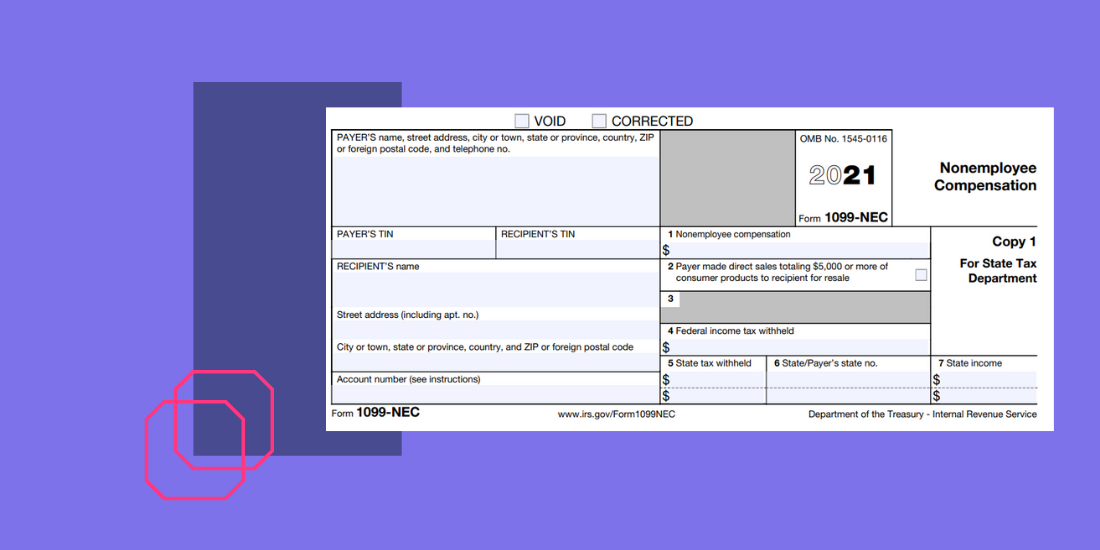

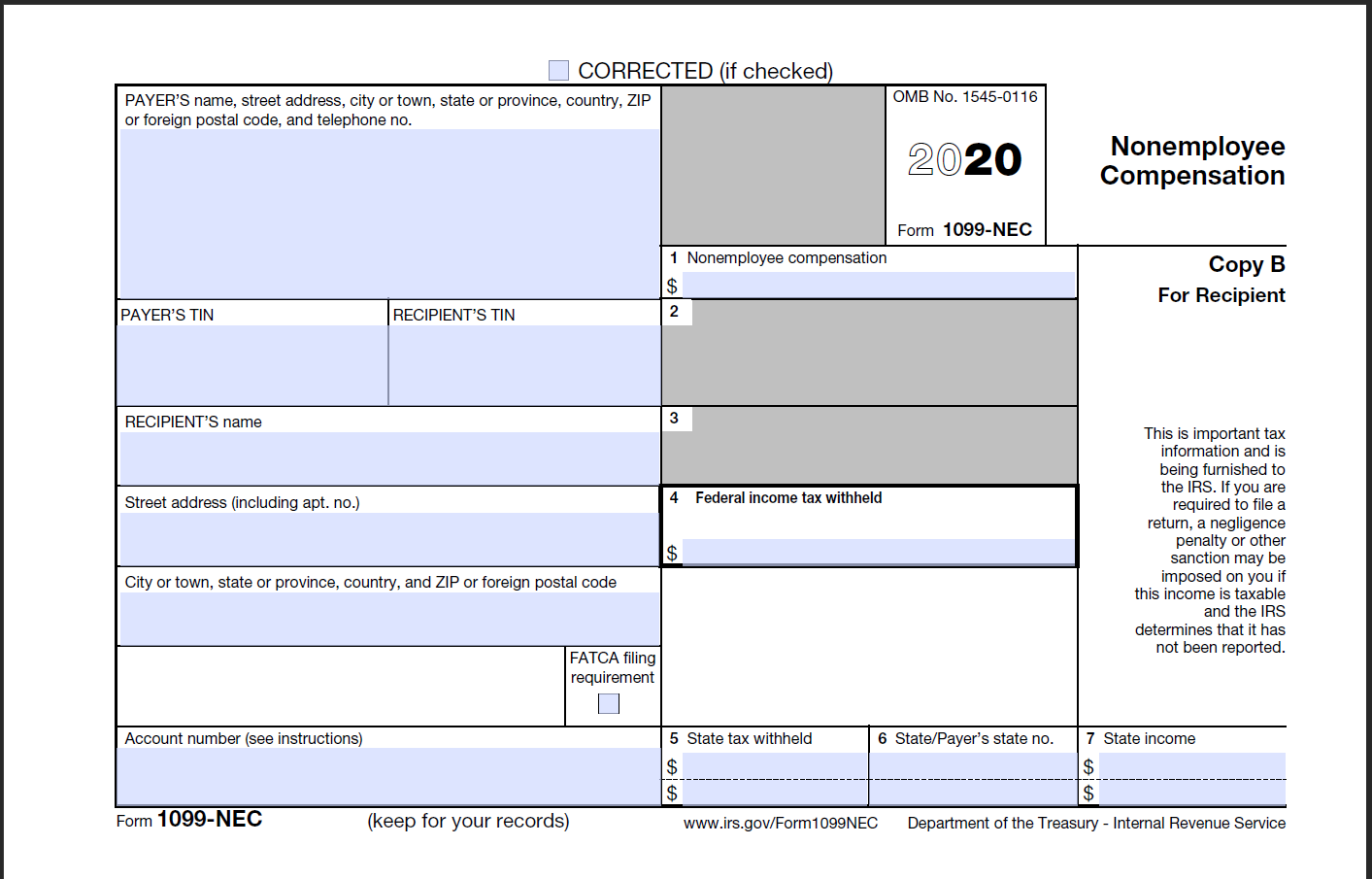

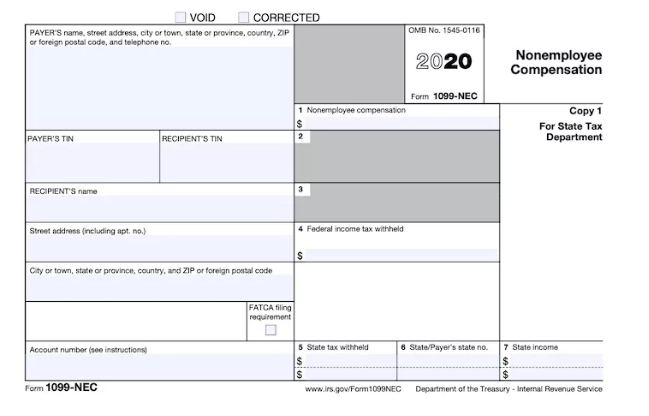

Does paypal issue 1099-nec. If you processed over 20000 in payment volume and you had 200 or more transactions PayPal and other payment settlement companies are required to send you a 1099-K in most states. Form 1099-NEC Nonemployee Compensation is a form that solely reports nonemployee compensation. And the contractor may even have their account closed for misusing the system or at the very least be told they have to convert it to a business account.

You can access your 1099-K from your PayPal account by January 31st annually. If you had less than 20000 and 200 or fewer transactions then you usually have to file the 1099-NEC Nonemployee Compensation. This Is Also Pissing Off Your Partners.

If youre wondering why this is remember that the purpose of a 1099 is to prevent tax-dodging. If you cross the IRS thresholds in a given calendar year PayPal will send Form 1099-K to you and the IRS for that tax year the following year. This was previously reported in box 7 of Form 1099-MISC.

That is the case even if you paid the recipient more than 600 last year. Yes you are correct that you do not need to send Form 1099-MISC. PayPal doesnt recognize these payments as reportable on the 1099-K so if you pay a contractor with this option you will have to send them a 1099-NEC.

By the way it is worded people could infer incorrectly that returns for calendar years beginning after December 31 2021 is referring to the 1099K issued in 2022 for transactions occurring in 2021. You paid the vendor through PayPal or using a credit card. PayPal issues the 1099K in January or February of every year.

Form 1099-NEC is not a replacement for Form 1099-MISC. Form 1099-NEC is only replacing the use of Form 1099-MISC for reporting independent contractor payments. You are not required to send a 1099 form to independent contractors such as freelancers or to other unincorporated businesses such as LLCs if you paid them via PayPal or credit card.

January 31 is the federal deadline for reporting nonemployee compensation on Form 1099-NEC. Only those customers that meet the 1099-K eligibility requirements will see the 1099-K available for download in their account. Payments to 1099 vendors made via credit card debit card or third party system such as PayPal are excluded from the 1099-MISC and 1099-NEC calculations.

If you cross the IRS thresholds in a given calendar year PayPal will send Form 1099-K to you and the IRS for that tax year the following year. Both requirements must be metif you start selling in. This is because the financial institution reports these payments so you dont have to.

In this situation the taxpayer will be looking at 1099s totaling 100000 when in fact only. You should get 1099 from Paypal sometime in Januaryif you meet 200 transactions and 20k in payment collected via goods and services. You can access your 1099-K from your PayPal account by January 31st annually.

Then each will get a 1099-Misc from your company. If you paid a person or business via PayPals Friends and Family option you will need to issue a 1099-NEC to them. If all the payments are made through PayPal PayPal may then issue form 1099-K also for 50000.

If you use the Friends and Family option for payment through PayPal or a similar option through Venmo or Wave you may need to issue a 1099-MISC for the payment. When you use this method to transfer funds PayPal assumes its a non-business transaction and doesnt include it in their 1099-K. Form 1099-NEC is used to report nonemployee compensation.

Compensation only needs to be reported on Form 1099-NEC if it exceeds 600 for the previous tax year. Thats right even if you pay more than 600 to an unincorporated entity you still dont have to file a 1099 if you use PayPal or a credit card. If you paid any of your contractors 600 or more each via Paypal Venmo Stipe Square etc.

Nonemployee compensation was previously included on the 1099-MISC form. According to the IRS Instructions for Form 1099-MISC Payments made with a credit card or payment card and certain other types of payments including third-party network transactions must be reported on Form 1099-K by the payment settlement entity under section 6050W and are not subject to reporting on Form 1099-MISC. The answer is.

The only time they will get a. The tax form will only be issued if the payment meets the other requirements for issuing a.

1099 Div Form 2020 Information Instructions For Form 1099 Div In 2021 Filing Taxes State Tax Guidelines

1099 Div Form 2020 Information Instructions For Form 1099 Div In 2021 Filing Taxes State Tax Guidelines

Will I Receive A 1099 Nec 1099 Misc Form Support

Will I Receive A 1099 Nec 1099 Misc Form Support

What S The Deadline The 1099 Deadline Specifically 1099 Misc Is January 31 2017 To Send 1099s To The Recipien Small Business Tax Credit Repair Business Tax

What S The Deadline The 1099 Deadline Specifically 1099 Misc Is January 31 2017 To Send 1099s To The Recipien Small Business Tax Credit Repair Business Tax

What Is A 1099 Nec And What Do I Need To Know About 1099s Jetro Small Business Accountant

What Is A 1099 Nec And What Do I Need To Know About 1099s Jetro Small Business Accountant

Filing 1099s Who Gets One Capforge

Filing 1099s Who Gets One Capforge

Paypal 1099 Taxes The Complete Guide

Paypal 1099 Taxes The Complete Guide

Download W 2 Form Ezw2 Software Simplifies W2 Filing For New Business Owner W2 Forms Power Of Attorney Form Fillable Forms

Download W 2 Form Ezw2 Software Simplifies W2 Filing For New Business Owner W2 Forms Power Of Attorney Form Fillable Forms

Understanding Your Tax Forms 2016 1099 K Payment Card And Third Party Network Transactions Tax Forms W2 Forms Ways To Get Money

Understanding Your Tax Forms 2016 1099 K Payment Card And Third Party Network Transactions Tax Forms W2 Forms Ways To Get Money

What Is A 1099 Nec And What Do I Need To Know About 1099s Jetro Small Business Accountant

What Is A 1099 Nec And What Do I Need To Know About 1099s Jetro Small Business Accountant

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service 1099 Tax Form Meeting Agenda Template Irs Forms

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service 1099 Tax Form Meeting Agenda Template Irs Forms

Wordpsd Com Editable Id Card Passport And Credit Cards Templates That Can Be Easily Modified To Meet Your Card Templates Printable Templates Id Card Template

Wordpsd Com Editable Id Card Passport And Credit Cards Templates That Can Be Easily Modified To Meet Your Card Templates Printable Templates Id Card Template

All About Forms 1099 Nec And 1099 K Brightwater Accounting

All About Forms 1099 Nec And 1099 K Brightwater Accounting

Understanding The 1099 K Gusto

Understanding The 1099 K Gusto

Buzzfeed Has Breaking News Vital Journalism Quizzes Videos Celeb News Tasty Buzzfeed Has Breaking New Small Business Tax Tax Write Offs Business Tax

Buzzfeed Has Breaking News Vital Journalism Quizzes Videos Celeb News Tasty Buzzfeed Has Breaking New Small Business Tax Tax Write Offs Business Tax

Am I Supposed To File This New 1099 Nec Form Or A 1099 Misc Form What Even Is The Difference Radical Profits Club

Rules For When To Issue A 1099 Form To A Vendor The Dancing Accountant

Rules For When To Issue A 1099 Form To A Vendor The Dancing Accountant