How To File 1099-misc Electronically From Quickbooks

Import 1099 Misc Data from QuickBooks. In the 1099 E-File dialog use 11111 no quotes for the TCC code since you are filing with the state.

Select From QuickBooks W2 andor 1099 Data.

How to file 1099-misc electronically from quickbooks. If you dont have payroll or QuickBooks you can use your standalone 1099 e-file service to file both the 1099-MISC and 1099-NEC with the IRS. Have lots of forms to file. Click Import Data from the top menu.

Import 1099 Misc Data from QuickBooks. Follow these steps to file Oklahoma 1099 forms electronically using W2 Mate Software. Click to securely e-file with the IRS.

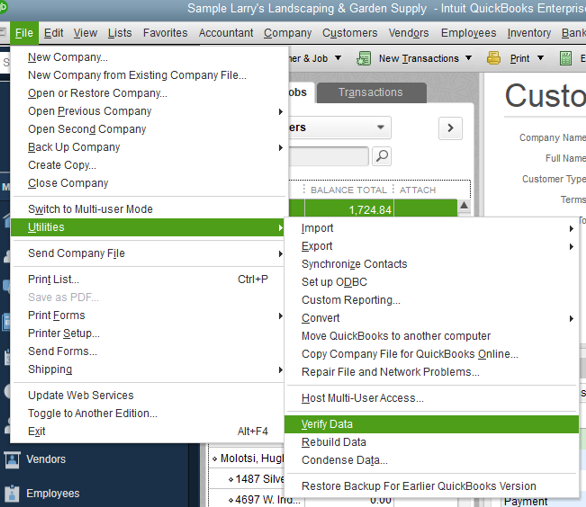

Now that youve prepared and verified that the information is correct on your 1099s its time to e-file. EFile 1099 MISC and more IRS forms 2020 eFiling is secure and easy by importing 1099 data with top integrations. If you plan on mailing in.

Select the Electronic Filing tab at the top. Once completed you can email them or. If you use our paid one-time service or sign up for a monthly payroll subscription we will auto-populate the correct forms and file them with the IRS for you.

This will open the QuickBooks Import wizard. Filing Information Returns Electronically FIRE FIRE is dedicated exclusively to the electronic filing of Forms 1042-S 1098 1099 5498 8027 and W-2G. Or select Ill file myself to print and mail the forms yourself.

Start by importing or manually entering your 1099-MISC data inside W2 Mate software. Save money and avoid hassle of purchasing forms stamps and mailing. Continue to create and transmit your electronic file to the IRS.

The IRS will forward the file to the state. Upload them all at once with our Excel templates or import directly from QuickBooks and Xero to save. With this feature youre able to view and get your copy online using a free QuickBooks Self-Employed QBSE account.

Award-Winning IRS-Authorized e-Filing Platform. You can easily E-file your 1099s with QuickBooks. This will open the QuickBooks Import wizard.

To be on the safe side select from the top menu inside W2 Mate Tools Other Recipient 1099 Tools Update Box 17 State Payers State for multiple 1099-MISC Recipients and select WI as the state abbreviation and the state ID NO Dashes. Check the box that says Participate in the Combined FederalState Filer Program. Select From QuickBooks W2 andor 1099 Data.

However if it has been accepted you need to wait until your original return is processed by the IRS and file an amended return. From the top menu inside W2 Mate select E-Filing. After preparing your 1099s select the E-File for me option.

Also information about how to file returns electronically or magnetically. Easily enter 1099-MISC information. If youre filing electronically use the online form.

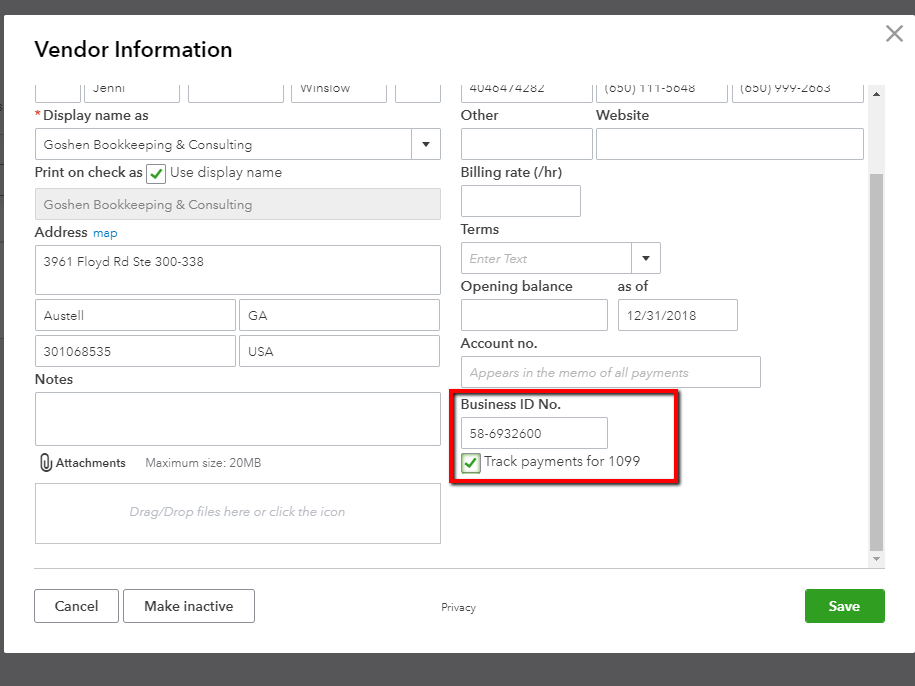

Verify your 1099 Forms then select Continue. Included are help-line telephone numbers and direct links to aid you in reporting information returns. Your vendor has the option to invite you to complete your W-9 information and use our 1099 e-file service through QuickBooks Online QBO in filing your form.

Print or email copies to your contractors. You can download free trial of W2 Mate from the page below. File 1099 Online with IRS approved eFile Service provider Tax1099.

If your efiled return was rejected you can go back into TurboTax and fix the mistake on your 1099-MISC and then submit the corrected return. From the top menu inside W2 Mate select E-Filing 1099-MISC Forms. Simply add your contractor and payment info to create and e-file 1099s.

Step by Step Instructions. 47 rows How to E-file QuickBooks 1099-MISC Forms with Michigan W2 Mate is comprehensive. Skip filling out Form 1096 or W-3 because we automatically calculate the totals and transmit that information electronically.

If you use QuickBooks Online you can import your 1099 data. Click Import Data from the top menu. Make sure you have the correct Company open inside W2 Mate.

Make sure you have the correct Company open inside W2 Mate. Select E-File for me to e-file your 1099s. Step by Step Instructions.

Product Review Quickbooks 1099 E File Service Stratton Ltd

Product Review Quickbooks 1099 E File Service Stratton Ltd

Fix Quickbooks Generated Zero Amount Transaction Quickbooks Quickbooks Payroll Generation

Fix Quickbooks Generated Zero Amount Transaction Quickbooks Quickbooks Payroll Generation

How To Prepare And File 1099s In Quickbooks Online

How To Prepare And File 1099s In Quickbooks Online

Create And File 1099s Using Quickbooks Online

Create And File 1099s Using Quickbooks Online

Quickbooks Comforts You To Remain Your Business Running Effortlessly And To Generate The Reports As Per The Wants Quickbooks Payroll Quickbooks Quickbooks Pro

Quickbooks Comforts You To Remain Your Business Running Effortlessly And To Generate The Reports As Per The Wants Quickbooks Payroll Quickbooks Quickbooks Pro

How To Prepare And File 1099s In Quickbooks Online

How To Prepare And File 1099s In Quickbooks Online

Quickbooks Online Prepare 1099 Forms 1099 Misc For Independent Contractors Youtube

Quickbooks Online Prepare 1099 Forms 1099 Misc For Independent Contractors Youtube

Simplify The Quickbooks 1099 Process With Track1099 Enix Associates

Simplify The Quickbooks 1099 Process With Track1099 Enix Associates

11 Form How To Fill Out How Will 11 Form How To Fill Out Be In The Future Irs Forms 1099 Tax Form Tax Forms

11 Form How To Fill Out How Will 11 Form How To Fill Out Be In The Future Irs Forms 1099 Tax Form Tax Forms

Using The 1099 Wizard To Create 1099s

Using The 1099 Wizard To Create 1099s