Iowa Corporate Income Tax Extension Form

Iowa offers a 6-month extension which moves the filing deadline to October 30 for calendar year taxpayers. Iowa business income taxpayers are not required to file an extension form if they find they cannot meet their annual return filing deadline.

Https Tax Iowa Gov Sites Default Files 2020 03 2019 20expanded 20instructions 031120 Pdf

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities and are used by the revenue department to record the purpose of the check and the SSNEIN of the taxpayer who sent it.

Iowa corporate income tax extension form. Payment Voucher for 2020 Corporation Income and Replacement Tax Use this voucher and Appendix A of Form IL-1120 Instructions to make a 2020 extension payment 2021-IL-1120-V. Deadline for taxpayers who got a IA Tax Extension to file their Iowa Income Tax Return by mail-in Forms - the Forms incl. All publicly distributed Iowa tax forms can be found on the Iowa Department of Revenues tax form index site.

Read more about IA 8827 Corporate Iowa Alternative Minimum TaxTax Credit 42-015. If you need to make a payment you can mail the form at the bottom of the worksheet with your check. The Department does not have an extension form to obtain additional time to file.

The actual due date to file Form IA 1040 is April 30 or by the 30th day of the 4th month after the tax year ends. Form 5S Tax-option S corporation franchise or income tax return o 15 th day of 3 rd month after end of taxable year Form 4T Business franchise or income tax return for exempt organizations taxable as corporations o 15 th day of 5 th month after end of taxable year Form 4H Declaration of inactivity o 15 th day of 4th month after end of taxable year. Iowa personal tax return is extended to June 1 2021 for calendar tax year filers.

While most taxpayers have income taxes automatically withheld every pay period by their employer taxpayers who earn money that is not subject to withholding such as self employed income investment returns etc are often required to make estimated tax payments on a quarterly basis. Iowa has no paper extension form. You have until January 31 2021 to file your return timely.

Line 56 3000. The Iowa business extension is automatic meaning that. IA 1120V Corporation Income Tax Payment Voucher 42-019.

If the result is equal to or less than the amount on line 66 of the IA 1040 an extension is automatic. 90 of the tax has not been paid. Extended Deadline with Iowa Tax Extension.

A federal extension does not apply for Iowa purposes. As long as youve paid at least 90 of your state tax liability by the original deadline April 30 you will automatically receive a 6-month Iowa tax extension. Iowa Tax Extension Form.

Browse them all here. Ensuring you have a valid extension. Taxpayers will be given an automatic six-month extension to file as long as 90 percent of the tax due was paid by the original due date of the return.

If you have at least 90 of the tax paid by the due date you will automatically have until October 31 to file the return. Law. 5000 x 90 4500.

After you finish the worksheet do one of the following. Corporation Income and Replacement Tax Return. Corporation income tax returns are due by April 30 or by the last day of the 4 th month following the close of the taxable year for fiscal year filers.

Line 66 4000. Optionally the eFileIT deadline is Oct. Mailing addresses are listed below - is October 31 2021.

Taxpayers filing returns reporting unrelated business income tax receive an automatic 8-month extension to file. No extension is available to this taxpayer. If at least 90 of your total tax liability is paid by July 31 2020 you will automatically have an additional six months to file your return.

3000 x 90 2700. This applies to taxpayers currently filing Form M-990T. Adopted and Filed Rules.

Line 56 5000. We have two worksheets to help you make sure you have a valid extension to file late. IA 8827 Corporate Iowa Alternative Minimum TaxTax Credit 42-015.

Report Fraud. Extension payments can be made using Form IA 1120V Corporation Tax Payment Voucher. If an additional payment is necessary in order to meet the 90 requirement you must make payment using the Iowa Individual Income Tax Payment Voucher 41-137.

Tax Credits. The order allows Iowa residents or non-resident individuals required to file Iowa returns an extension for filing the IA 1040 Individual Income Tax Return and all supporting forms. Form IA 1120V is an Iowa Corporate Income Tax form.

Iowa Filing Due Date. If you owe zero Iowa tax you will be granted an automatic extension without having to do anything. This taxpayer will owe penalty and interest on the unpaid tax.

Or you can make a state tax payment online via Iowas. Form 51 is for individual income tax. Form IA 1120ES is an Iowa Corporate Income Tax form.

Form 41ES is for business income tax.

Https Tax Iowa Gov Sites Default Files Idr Tax 20credits 20users 20manual 202018 Pdf

Iowa Department Of Revenue Extends Iowa Tax Deadline To June 1 Weareiowa Com

Iowa Department Of Revenue Extends Iowa Tax Deadline To June 1 Weareiowa Com

Https Tax Iowa Gov Sites Default Files 2021 01 Ia1120inst 2842002 29 Pdf

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

Iowa Extends State Income Tax Deadline To July 31 Political News Wcfcourier Com

Iowa Extends State Income Tax Deadline To July 31 Political News Wcfcourier Com

State Individual Income Tax Deadline Extended

State Individual Income Tax Deadline Extended

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Form Ia 1120x Fillable Iowa Amended Corporation Income Tax Return 42 024

W 2 1099 Electronic Filing Iowa Department Of Revenue

W 2 1099 Electronic Filing Iowa Department Of Revenue

Iowa 1040 Fill Out And Sign Printable Pdf Template Signnow

Iowa 1040 Fill Out And Sign Printable Pdf Template Signnow

Https Tax Iowa Gov Sites Default Files 2020 07 Ia1120inst 42002 Pdf

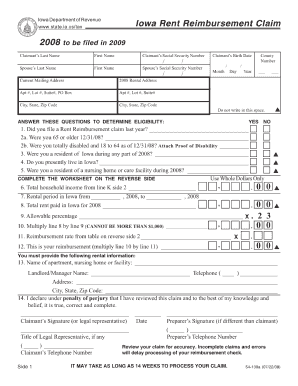

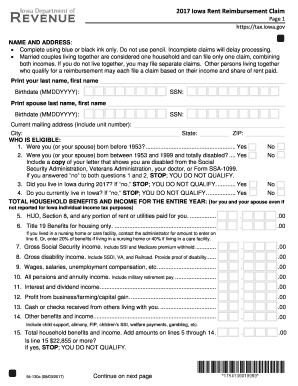

Rent Rebate Application Iowa Fill Online Printable Fillable Blank Pdffiller

Rent Rebate Application Iowa Fill Online Printable Fillable Blank Pdffiller

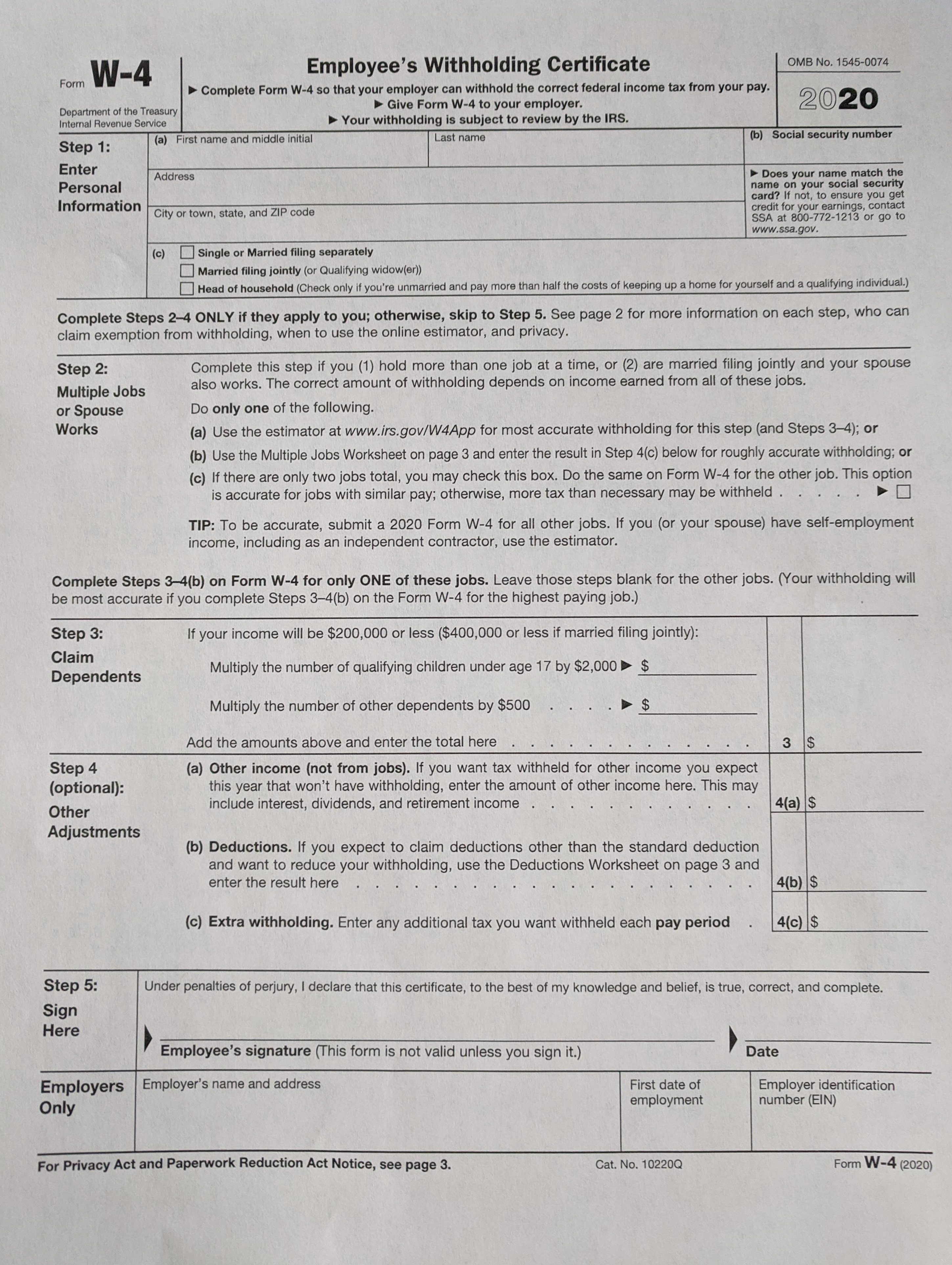

New 2020 Form W 4 Answerline Iowa State University Extension And Outreach

New 2020 Form W 4 Answerline Iowa State University Extension And Outreach

When Are State Tax Returns Due In Iowa Kiplinger

When Are State Tax Returns Due In Iowa Kiplinger

Iowa Department Of Revenue Extends Iowa Tax Deadline To June 1 Weareiowa Com

Iowa Department Of Revenue Extends Iowa Tax Deadline To June 1 Weareiowa Com

Rent Reimbursement Fill Out And Sign Printable Pdf Template Signnow

Rent Reimbursement Fill Out And Sign Printable Pdf Template Signnow

Irs Extends March 1 Filing Deadline For Farmers Center For Agricultural Law And Taxation

Irs Extends March 1 Filing Deadline For Farmers Center For Agricultural Law And Taxation