How To Fill Out And Send 1099 Forms

Click Here to Create Your Form 1099-Misc in Less Than 2 Minutes. Start completing the fillable fields and carefully type in required information.

Use Get Form or simply click on the template preview to open it in the editor.

How to fill out and send 1099 forms. Complete your personal details in the box in the top-left. The amount you paid them. Some accounting software has these forms included.

Use the Cross or Check marks in the top toolbar to select your answers in the list boxes. If you miss this deadline you will be ending up paying the IRS penalty for late submission and your contractors will end up paying and filing their taxes late. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

You can request a TCC by filling out Form 4419 and then mailing or faxing it to the IRS. 201 accelerated the due date for filing Form 1099 that includes nonemployee compensation NEC from February 28 to January 31 and eliminated the automatic 30-day extension for forms that include NEC. You must send the form specifically a Copy B of form 1099-NEC to the contractor no later than February 1st.

File a final Form 1099-B for the year the short sale is closed as described above but do not include the 2021 tax withheld on that Form 1099-B. In box 1a enter a brief description of the transaction for example 5000 short sale of 100 shares of ABC stock not closed. Read on to learn about the difference between a contractor and an employee how to.

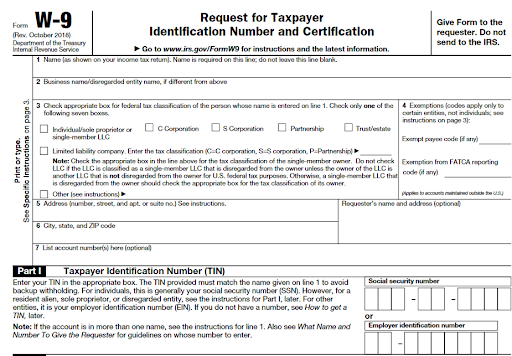

Quick steps to complete and e-sign 1099 Form online. If you find the process complex its much better to talk to a tax. Fill in your tax ID number.

Follow If you already mailed or eFiled your form 1099s to the IRS and now need to make a correction you will need to file by paper copy a Red Copy A and 1096 fill out and mail to the IRS if you need further assistance preparing your corrected paper copy please contact your local tax provider or call the IRS at 800 829-3676. For the 2020 tax year the Federal Tax 1099-Misc Form is not used for reporting non-employee payments. You have to either order them from the IRS or pick them up at an office supply store.

At the end of the year youll need to fill out a 1099-NEC form to send to those contractors and the IRS. As an independent contractor use your social security number. How to Fill Out a 1099-MISC Form Step One.

Both companies and individuals may need to fill out a 1099. Enter your information in the payer section. Start completing the fillable fields and carefully type in required information.

The next step is to send out the forms to the contractor and to the IRS. The PATH Act PL. On a half sheet form you fill in a few boxes.

This will save you a ton of money in the long run. Once the IRS contacts you with your TCC you may use it to create an account with FIRE. Filers who need to send out 1099-Misc can get Free Fillable 1099-Misc Form from the IRS website or E-file provider.

Like the IRS tax form 1040-SR retirees send the form to the IRS to confirm the accuracy of their tax return. Step 2 - Grab Your Forms. For example employers will send out W-9 forms when they first begin working with an independent contractor to collect their tax information but they will also complete a 1099 at the end of the year to record the total payments they made to that contractor.

Complete an additional 1099-NEC for this information if you must enter data for more than two states because the form only accommodates two. Reporting your taxable income will be used for both federal and state taxes. Use Get Form or simply click on the template preview to open it in the editor.

This form must be submitted at least 30 days before the tax deadline for your Form 1099-NEC. Leave the other numbered boxes blank. You cannot download these.

Enter the persons state income any state taxes you might have withheld and identify the state or states to which youll be reporting. How To Fill Out Form 1099-R Distributions From Pensions Annuities Retirement Etc. Beginning with tax year 2020 use Form 1099-NEC to report nonemployee compensation.

Your name address phone number and tax ID number. IRS reintroduces 1099-NEC Form for reporting non-employee payments instead of 1099-Misc Box 7. Step 3 - Fill Out the Forms.

Quick steps to complete and e-sign 1099 R Form online. Your recipients name address tax ID number.

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

How To File 1099 Misc For Independent Contractor

How To File 1099 Misc For Independent Contractor

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

1099 Misc Form Reporting Requirements Chicago Accounting Company

1099 Misc Form Reporting Requirements Chicago Accounting Company

Do I Need To File 1099s Deb Evans Tax Company

Do I Need To File 1099s Deb Evans Tax Company

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Cpa Practice Advisor

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Cpa Practice Advisor

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

1099 Misc Form Copy C 2 Recipient State Zbp Forms

1099 Misc Form Copy C 2 Recipient State Zbp Forms

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

1099 Misc Form Copy B Recipient Discount Tax Forms

1099 Misc Form Copy B Recipient Discount Tax Forms

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager